Goooooood Morning!! (or evening for my ozzie friends!)

I’ve been away from the computer for the most part this week, although I did take a few hours to try to catch up on the over 800 emails in my in box- (if you emailed me before July 28…. I’m afraid that your email most likely got deleted- it was an act of desperation), and catching up with the on going conversations in the various skype rooms, and reading reading reading….

More transparency coming out this week from all sorts of sources and a couple of these articles are very pointed in the data that they are outing. I have two articles that I’m currently working on, but for the moment… here is some reading material- all the latest bits of news this week that the research crew and a few others dug up. Again, the hugest hug to the research team who are just going gangbusters and digging up so much stuff!!

My comments in Purple.

First off, a man in Russia decides he doesn’t’ like the “fine print” of the credit card application he’s given, so he writes in his own terms and conditions …. I’m pretty sure Tinkoff Credit systems isn’t the only credit card company that just rubber stamps these “applications” (actually a contract).

Disappointed by the terms of the unsolicited offer for a credit card from Tinkoff Credit Systems in 2008, a 42-year-old Dmitry Agarkov from the city of Voronezh decided to hand write his own credits terms.

The trick was that Agarkov simply scanned the bank’s document and ‘amended’ the small print with his own terms.

He opted for a 0 percent interest rate and no fees, adding that the customer “is not obliged to pay any fees and charges imposed by bank tariffs.” The bank, however, didn’t read ‘the amendments’, as it signed and certified the document, as well as sent the man a credit card. Under the agreement, the bank OK’d to provide unlimited credit, according to Agarkov’s lawyer Dmitry Mikhalevich talking to Kommersant daily.

“The opened credit line was unlimited. He could afford to buy an island somewhere in Malaysia, and the bank would have to pay for it by law,” Mikhalevich added.

Agarkov also changed the URL of the site where the terms and conditions were published and hedged against the bank’s breaking of the agreement. For each unilateral change in the terms provided in the agreement, the bank would be asked to pay the customer (Agarkov) 3 million rubles ($91,000), or a cancelation fee of 6 million rubles ($182,000)…..

This one was one of my favorites this week…. I giggled my ass off!

5 signs Wall Street’s zombie apocalypse is at hand

Commentary: Undead money pros mindlessly repeating upbeat phrasesBy Brett Arends

A reader writes:

“Please help me. I have just finished watching ‘The Walking Dead’ on AMC and ‘World War Z’ in the cinema, and I’ve started to suspect that my money manager may be a zombie. I’ve been watching business TV and I think a lot of the people on Wall Street must be zombies as well. How can I be sure? Are there any tell-tale signs?”

— Yours, Terrified in Tuscaloosa

Dear Terrified,

Thanks for your email. I think you are on to something.

Some of us have suspected for a number of years that the Zombie Apocalypse has begun. (Have you noticed, for example, how few people actually think any more? They’re just walking around like… well, like zombies.)

Ryan Jorgensen – Jorgo / e

It’s especially bad on Wall Street. Actually, a zombie epidemic would explain a lot—especially the tendency of financial commentators to be so nonsensically upbeat.

If you study zombie-lore from Haiti, you’ll find that classic zombies have lost all free will. They are basically automatons, doing the same things, over and over again, mindlessly.

Does that remind you of the denizens of any Street you know?

Unlike a zombie, most M.B.A. money-managers can actually form complete sentences, but what they have to say isn’t much more intelligent than the grunting of a B-movie monster. Here are five phrases that are a surefire giveaway you’re dealing with a financial zombie.

1. “Mmmmwwaaaahhhh…. Cash on sidelines… market going higher.”

You can pretty much switch on any business program on TV during market hours and hear this sentence being repeated like a mantra. Guess what? There is no “money on the sidelines” waiting to come into this market and magically drive share prices further up. There can’t be. Why not? Because every time someone buys a share, someone else has to sell it to them. As a result, the share and the cash simply change hands. No money has “come into” the market at all.

This is a matter of simple logic, yet the cash-on-the-sidelines mantra refuses to die. What is the explanation? Zombies!

2. “Aaaarrrgghhh… great rotation coming… out of bonds… into stocks.”

This is a first cousin of the “money on the sidelines” argument. This argument is that “everyone” is loaded up to the gunwales with bonds and that they are all going to sell their bonds and buy stocks. Alas, the premise is nonsense for exactly the same reason that the “cash-on-the-sidelines” argument is nonsense. “Everyone” can’t sell bonds and buy stocks, because every time someone sells a bond, someone else has to buy it, and every time someone buys a stock, someone else has to sell it. The cards change hands, but the deck remains the same. Zombie!…..

This article by AK caused a lot of discussion- albeit mostly uproariously laughing…… Well…. they have to fund the RV somehow, right?

Flying high with 24 tons of Cocaine. I did a quick calculation at $30,000 per kilo on the street that’s $680.4 billion dollars of blow in one plane. Some bank somewhere needing some quick cash? – BillCosta Rica Will Stop Sending Cocaine to Miami

Posted by Jaime Lopez on August 5, 2013 in Costa Rica News, Politics NewsAccording to an official press release from the Organization of Judicial Investigations (OIJ in Spanish), Costa Rica will no longer send cocaine or other controlled substances to the United States, at least for the time being. The announcement comes in the wake of news reports about nearly 24 tons of cocaine transported by the U.S. Air Force to Miami on Saturday, July 27th 2013.

The OIJ further explained that officials in Costa Rica had spoken to the U.S. Drug Enforcement Administration (DEA) about the temporary lack of an incinerator to destroy seized powder cocaine, marijuana and other illegal drugs. Prior to the massive airlift of cocaine to Miami in late July, the OIJ had managed to destroy almost 23 tons of drugs over the years at a cement factory in Cartago, but a couple of unfortunate incidents resulted in the stockpiling of confiscated drugs, and the OIJ ended up with too much coke…..

Flying high with 24 tons of Cocaine. I did a quick calculation at $30,000 per kilo on the street that’s $680.4 billion dollars of blow in one plane. Some bank somewhere needing some quick cash? – Bill

Costa Rica Will Stop Sending Cocaine to Miami

Posted by Jaime Lopez on August 5, 2013 in Costa Rica News, Politics NewsAccording to an official press release from the Organization of Judicial Investigations (OIJ in Spanish), Costa Rica will no longer send cocaine or other controlled substances to the United States, at least for the time being. The announcement comes in the wake of news reports about nearly 24 tons of cocaine transported by the U.S. Air Force to Miami on Saturday, July 27th 2013.

The OIJ further explained that officials in Costa Rica had spoken to the U.S. Drug Enforcement Administration (DEA) about the temporary lack of an incinerator to destroy seized powder cocaine, marijuana and other illegal drugs. Prior to the massive airlift of cocaine to Miami in late July, the OIJ had managed to destroy almost 23 tons of drugs over the years at a cement factory in Cartago, but a couple of unfortunate incidents resulted in the stockpiling of confiscated drugs, and the OIJ ended up with too much coke…..

Costa Rica Will Stop Sending Cocaine to Miami

Posted by Jaime Lopez on August 5, 2013 in Costa Rica News, Politics News

According to an official press release from the Organization of Judicial Investigations (OIJ in Spanish), Costa Rica will no longer send cocaine or other controlled substances to the United States, at least for the time being. The announcement comes in the wake of news reports about nearly 24 tons of cocaine transported by the U.S. Air Force to Miami on Saturday, July 27th 2013.The OIJ further explained that officials in Costa Rica had spoken to the U.S. Drug Enforcement Administration (DEA) about the temporary lack of an incinerator to destroy seized powder cocaine, marijuana and other illegal drugs. Prior to the massive airlift of cocaine to Miami in late July, the OIJ had managed to destroy almost 23 tons of drugs over the years at a cement factory in Cartago, but a couple of unfortunate incidents resulted in the stockpiling of confiscated drugs, and the OIJ ended up with too much coke…..

According to an official press release from the Organization of Judicial Investigations (OIJ in Spanish), Costa Rica will no longer send cocaine or other controlled substances to the United States, at least for the time being. The announcement comes in the wake of news reports about nearly 24 tons of cocaine transported by the U.S. Air Force to Miami on Saturday, July 27th 2013.

The OIJ further explained that officials in Costa Rica had spoken to the U.S. Drug Enforcement Administration (DEA) about the temporary lack of an incinerator to destroy seized powder cocaine, marijuana and other illegal drugs. Prior to the massive airlift of cocaine to Miami in late July, the OIJ had managed to destroy almost 23 tons of drugs over the years at a cement factory in Cartago, but a couple of unfortunate incidents resulted in the stockpiling of confiscated drugs, and the OIJ ended up with too much coke…..

The OIJ further explained that officials in Costa Rica had spoken to the U.S. Drug Enforcement Administration (DEA) about the temporary lack of an incinerator to destroy seized powder cocaine, marijuana and other illegal drugs. Prior to the massive airlift of cocaine to Miami in late July, the OIJ had managed to destroy almost 23 tons of drugs over the years at a cement factory in Cartago, but a couple of unfortunate incidents resulted in the stockpiling of confiscated drugs, and the OIJ ended up with too much coke…..

http://libertyblitzkrieg.com/2013/08/05/ny-times-admits-al-qaeda-terror-threat-used-to-divert-attention-from-nsa-uproar/

As I said last week- the closing a US Embassies in the Middle East has nothing to do with “Security” and everything to do with being bust broke!

NY Times Admits: Al-Qaeda Terror Threat Used to “Divert Attention” from NSA Uproar

Posted on August 5, 2013

Some analysts and Congressional officials suggested Friday that emphasizing a terrorist threat now was a good way to divert attention from the uproar over the N.S.A.’s data-collection programs, and that if it showed the intercepts had uncovered a possible plot, even better.

Nothing about the above quote should surprise any of my readers, we all know the sick, twisted mindset of those involved in the Military-Industrial-Wall Street complex. What’s more shocking is the fact that these folks so openly admit it to the New York Times, albeit in a typical anonymous and cowardly fashion. Let’s not forget what Robert

Shapiro, former Clinton official and Obama supporter told the FT in July 2010:

The bottom line here is that Americans don’t believe in President Obama’s leadership. He has to find some way between now and November of demonstrating that he is a leader who can command confidence and, short of a 9/11 event or an Oklahoma City bombing, I can’t think of how he could do that……

Lavabit- purportedly the “secure” email service provider that Snowdon used- has permanently closed it’s doors…. read between the lines folks!

I have been forced to make a difficult decision: to become complicit in crimes against the American people or walk away from nearly ten years of hard work by shutting down Lavabit. After significant soul searching, I have decided to suspend operations. I wish that I could legally share with you the events that led to my decision. I cannot. I feel you deserve to know what’s going on–the first amendment is supposed to guarantee me the freedom to speak out in situations like this. Unfortunately, Congress has passed laws that say otherwise. As things currently stand, I cannot share my experiences over the last six weeks, even though I have twice made the appropriate requests.

What’s going to happen now? We’ve already started preparing the paperwork needed to continue to fight for the Constitution in the Fourth Circuit Court of Appeals. A favorable decision would allow me resurrect Lavabit as an American company.

This experience has taught me one very important lesson: without congressional action or a strong judicial precedent, I would _strongly_ recommend against anyone trusting their private data to a company with physical ties to the United States.

Sincerely,

Ladar Levison

Owner and Operator, Lavabit LLC

Defending the constitution is expensive! Help us by donating to the Lavabit Legal Defense Fund here.

Immediately followed by Silent Circle closing down their “secure” email services.

http://www.engadget.com/2013/08/08/silent-circle-follows-lavabits-example-shuts-down-its-secure-e/

Silent Circle follows Lavabit’s example, shuts down its secure email service

By Richard Lawler posted Aug 8th, 2013 at 11:49 PM 26

Silent Circle’s thing has always been the promise of end-to-end secure communications, and that drive is apparently causing it to shut down the Silent Mail email service. Reasons cited in a blog post by CTO Jon Callas include the insecure nature of email protocols and preemptively avoiding the outside (read: FISA) pressures that prompted Lavabit to close its doors. Silent Circle says it hadn’t received any “subpoenas, warrants, security letters, or anything else”. Still, CEO Michael Janke tellsTechCrunch he believed the government would come knocking due to certain high profile users of the service. Its phone, video and text products remain operational and claim to be “secure as ever”, if you’re wondering.

Hey Caleb… is the iphone and desktop aps ready to go yet? Last I heard from Caleb, PXIII for the iphone and your computer will be out very very soon….

On the topic of whistle blowers and corrupt government agencies breaking laws to listen in on your conversations and read your emails…..

http://www.usatoday.com/story/news/nation/2013/08/04/fbi-informant-crimes-report/2613305/

Exclusive: FBI allowed informants to commit 5,600 crimes

Brad Heath, USA TODAY 6:05 a.m. EDT August 4, 2013

USA TODAY exclusive: New documents show FBI agents gave their informants permission to break the law thousands of times in 2011.

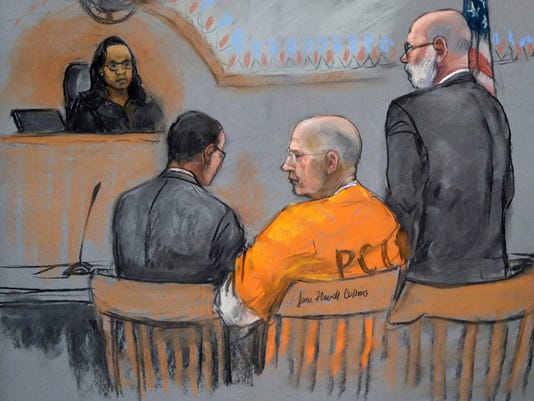

(Photo: Jane Flavell Collins, AP)Story Highlights

- FBI agents gave confidential informants permission to break the law 5,600 times in 2011

- New documents offer the first public view of how often FBI sources are allowed to break the law

- Rules were tightened after the FBI said it used accused mobster James “Whitey” Bulger as an informant

WASHINGTON — The FBI gave its informants permission to break the law at least 5,658 times in a single year, according to newly disclosed documents that show just how often the nation’s top law enforcement agency enlists criminals to help it battle crime……

OH. and apparently the DEA is WAY worse than the NSA for spying on you and breaking laws!!

http://www.businessinsider.com/the-dea-spying-scandal-is-bad-2013-8

Military & Defense More: Edward Snowden Surveillance NSA Spying

If You Thought NSA Spying Was Bad, You Should See What The DEA Is Doing

Michael Kelley Aug. 5, 2013, 6:00 PM

REUTERS/Mike Blake

John Shiffman and Kristina Cooke of Reuters report that a secretive Drug Enforcement Administration (DEA) unit is handing out “intelligence intercepts, wiretaps, informants and a massive database of telephone records to authorities across the nation to help them launch criminal investigations of Americans,” and then lying about how the investigations begin….

Back to America Kabuki- Bill and I have been following this story for a while:

Court officially declares Bitcoin a real currency

Court officially declares Bitcoin a real currency

Published time: August 08, 2013 15:54 Get short URL

http://rt.com/usa/bitcoin-sec-shavers-texas-231/

A federal judge has for the first time ruled that Bitcoin is a legitimate currency, opening up the possibility for the digital crypto-cash to soon be regulated by governmental overseers.United States Magistrate Judge Amos Mazzant for the Eastern District of Texas ruled Tuesday that the US Securities and Exchange Commission can proceed with a lawsuit against the operator of a Bitcoin-based hedge fund because, despite existing only on the digital realm, “Bitcoin is a currency or form of money.”

Trendon Shavers of Bitcoin Savings & Trust (BTCST) was accused last year of scamming customers out of roughly $4.5 million worth of the cryptocurrency through his online hedge-fund. Shavers promised investors a weekly return of 7 percent, according to the federal complaint, but shut-down his site after collecting upwards of 700,000 bitcoins. When the SEC charged Shavers last month with operating a Ponzi scheme, he fought back by saying Bitcoin is not actual currency and can’t be regulated.

“The SEC asserts that Shavers made a number of misrepresentations to investors regarding the nature of the investments and that he defrauded investors. However, the question currently before the Court is whether the BTCST investments in this case are securities as defined by Federal Securities Laws,” Judge Mazzant wrote this week. “Shavers argues that the BTCST investments are not securities because Bitcoin is not money, and is not part of anything regulated by the United States. Shavers also contends that his transactions were all Bitcoin transactions and that no money ever exchanged hands. The SEC argues that the BTCST investments are both investment contracts and notes, and, thus, are securities.”

Despite Shavers’ argument, Mazzant weighed in this week with an opinion that’s not only quite the contrary, but could have widespread repercussions in the world of Bitcoin.

“It is clear that Bitcoin can be used as money,” Mazzant wrote. “It can be used to purchase goods or services, and as Shavers stated, used to pay for individual living expenses. The only limitation of Bitcoin is that it is limited to those places that accept it as currency. However, it can also be exchanged for conventional currencies, such as the US dollar, Euro, Yen and Yuan. Therefore, Bitcoin is a currency or form of money, and investors wishing to invest in BTCST provided an investment of money.”

Bitcoin investments “meet the definition of investment contract, and as such, are securities,” the judge added….

Court officially declares Bitcoin a real currency

Published time: August 08, 2013 15:54 Get short URL

http://rt.com/usa/bitcoin-sec-shavers-texas-231/

A federal judge has for the first time ruled that Bitcoin is a legitimate currency, opening up the possibility for the digital crypto-cash to soon be regulated by governmental overseers.United States Magistrate Judge Amos Mazzant for the Eastern District of Texas ruled Tuesday that the US Securities and Exchange Commission can proceed with a lawsuit against the operator of a Bitcoin-based hedge fund because, despite existing only on the digital realm, “Bitcoin is a currency or form of money.”

Trendon Shavers of Bitcoin Savings & Trust (BTCST) was accused last year of scamming customers out of roughly $4.5 million worth of the cryptocurrency through his online hedge-fund. Shavers promised investors a weekly return of 7 percent, according to the federal complaint, but shut-down his site after collecting upwards of 700,000 bitcoins. When the SEC charged Shavers last month with operating a Ponzi scheme, he fought back by saying Bitcoin is not actual currency and can’t be regulated.

“The SEC asserts that Shavers made a number of misrepresentations to investors regarding the nature of the investments and that he defrauded investors. However, the question currently before the Court is whether the BTCST investments in this case are securities as defined by Federal Securities Laws,” Judge Mazzant wrote this week. “Shavers argues that the BTCST investments are not securities because Bitcoin is not money, and is not part of anything regulated by the United States. Shavers also contends that his transactions were all Bitcoin transactions and that no money ever exchanged hands. The SEC argues that the BTCST investments are both investment contracts and notes, and, thus, are securities.”

Despite Shavers’ argument, Mazzant weighed in this week with an opinion that’s not only quite the contrary, but could have widespread repercussions in the world of Bitcoin.

“It is clear that Bitcoin can be used as money,” Mazzant wrote. “It can be used to purchase goods or services, and as Shavers stated, used to pay for individual living expenses. The only limitation of Bitcoin is that it is limited to those places that accept it as currency. However, it can also be exchanged for conventional currencies, such as the US dollar, Euro, Yen and Yuan. Therefore, Bitcoin is a currency or form of money, and investors wishing to invest in BTCST provided an investment of money.”

Bitcoin investments “meet the definition of investment contract, and as such, are securities,” the judge added….

A federal judge has for the first time ruled that Bitcoin is a legitimate currency, opening up the possibility for the digital crypto-cash to soon be regulated by governmental overseers.

United States Magistrate Judge Amos Mazzant for the Eastern District of Texas ruled Tuesday that the US Securities and Exchange Commission can proceed with a lawsuit against the operator of a Bitcoin-based hedge fund because, despite existing only on the digital realm, “Bitcoin is a currency or form of money.”Trendon Shavers of Bitcoin Savings & Trust (BTCST) was accused last year of scamming customers out of roughly $4.5 million worth of the cryptocurrency through his online hedge-fund. Shavers promised investors a weekly return of 7 percent, according to the federal complaint, but shut-down his site after collecting upwards of 700,000 bitcoins. When the SEC charged Shavers last month with operating a Ponzi scheme, he fought back by saying Bitcoin is not actual currency and can’t be regulated.

“The SEC asserts that Shavers made a number of misrepresentations to investors regarding the nature of the investments and that he defrauded investors. However, the question currently before the Court is whether the BTCST investments in this case are securities as defined by Federal Securities Laws,” Judge Mazzant wrote this week. “Shavers argues that the BTCST investments are not securities because Bitcoin is not money, and is not part of anything regulated by the United States. Shavers also contends that his transactions were all Bitcoin transactions and that no money ever exchanged hands. The SEC argues that the BTCST investments are both investment contracts and notes, and, thus, are securities.”

Despite Shavers’ argument, Mazzant weighed in this week with an opinion that’s not only quite the contrary, but could have widespread repercussions in the world of Bitcoin.

“It is clear that Bitcoin can be used as money,” Mazzant wrote. “It can be used to purchase goods or services, and as Shavers stated, used to pay for individual living expenses. The only limitation of Bitcoin is that it is limited to those places that accept it as currency. However, it can also be exchanged for conventional currencies, such as the US dollar, Euro, Yen and Yuan. Therefore, Bitcoin is a currency or form of money, and investors wishing to invest in BTCST provided an investment of money.”

Bitcoin investments “meet the definition of investment contract, and as such, are securities,” the judge added….

United States Magistrate Judge Amos Mazzant for the Eastern District of Texas ruled Tuesday that the US Securities and Exchange Commission can proceed with a lawsuit against the operator of a Bitcoin-based hedge fund because, despite existing only on the digital realm, “Bitcoin is a currency or form of money.”

Trendon Shavers of Bitcoin Savings & Trust (BTCST) was accused last year of scamming customers out of roughly $4.5 million worth of the cryptocurrency through his online hedge-fund. Shavers promised investors a weekly return of 7 percent, according to the federal complaint, but shut-down his site after collecting upwards of 700,000 bitcoins. When the SEC charged Shavers last month with operating a Ponzi scheme, he fought back by saying Bitcoin is not actual currency and can’t be regulated.“The SEC asserts that Shavers made a number of misrepresentations to investors regarding the nature of the investments and that he defrauded investors. However, the question currently before the Court is whether the BTCST investments in this case are securities as defined by Federal Securities Laws,” Judge Mazzant wrote this week. “Shavers argues that the BTCST investments are not securities because Bitcoin is not money, and is not part of anything regulated by the United States. Shavers also contends that his transactions were all Bitcoin transactions and that no money ever exchanged hands. The SEC argues that the BTCST investments are both investment contracts and notes, and, thus, are securities.”

Despite Shavers’ argument, Mazzant weighed in this week with an opinion that’s not only quite the contrary, but could have widespread repercussions in the world of Bitcoin.

“It is clear that Bitcoin can be used as money,” Mazzant wrote. “It can be used to purchase goods or services, and as Shavers stated, used to pay for individual living expenses. The only limitation of Bitcoin is that it is limited to those places that accept it as currency. However, it can also be exchanged for conventional currencies, such as the US dollar, Euro, Yen and Yuan. Therefore, Bitcoin is a currency or form of money, and investors wishing to invest in BTCST provided an investment of money.”

Bitcoin investments “meet the definition of investment contract, and as such, are securities,” the judge added….

Trendon Shavers of Bitcoin Savings & Trust (BTCST) was accused last year of scamming customers out of roughly $4.5 million worth of the cryptocurrency through his online hedge-fund. Shavers promised investors a weekly return of 7 percent, according to the federal complaint, but shut-down his site after collecting upwards of 700,000 bitcoins. When the SEC charged Shavers last month with operating a Ponzi scheme, he fought back by saying Bitcoin is not actual currency and can’t be regulated.

“The SEC asserts that Shavers made a number of misrepresentations to investors regarding the nature of the investments and that he defrauded investors. However, the question currently before the Court is whether the BTCST investments in this case are securities as defined by Federal Securities Laws,” Judge Mazzant wrote this week. “Shavers argues that the BTCST investments are not securities because Bitcoin is not money, and is not part of anything regulated by the United States. Shavers also contends that his transactions were all Bitcoin transactions and that no money ever exchanged hands. The SEC argues that the BTCST investments are both investment contracts and notes, and, thus, are securities.”Despite Shavers’ argument, Mazzant weighed in this week with an opinion that’s not only quite the contrary, but could have widespread repercussions in the world of Bitcoin.

“It is clear that Bitcoin can be used as money,” Mazzant wrote. “It can be used to purchase goods or services, and as Shavers stated, used to pay for individual living expenses. The only limitation of Bitcoin is that it is limited to those places that accept it as currency. However, it can also be exchanged for conventional currencies, such as the US dollar, Euro, Yen and Yuan. Therefore, Bitcoin is a currency or form of money, and investors wishing to invest in BTCST provided an investment of money.”

Bitcoin investments “meet the definition of investment contract, and as such, are securities,” the judge added….

“The SEC asserts that Shavers made a number of misrepresentations to investors regarding the nature of the investments and that he defrauded investors. However, the question currently before the Court is whether the BTCST investments in this case are securities as defined by Federal Securities Laws,” Judge Mazzant wrote this week. “Shavers argues that the BTCST investments are not securities because Bitcoin is not money, and is not part of anything regulated by the United States. Shavers also contends that his transactions were all Bitcoin transactions and that no money ever exchanged hands. The SEC argues that the BTCST investments are both investment contracts and notes, and, thus, are securities.”

Despite Shavers’ argument, Mazzant weighed in this week with an opinion that’s not only quite the contrary, but could have widespread repercussions in the world of Bitcoin.“It is clear that Bitcoin can be used as money,” Mazzant wrote. “It can be used to purchase goods or services, and as Shavers stated, used to pay for individual living expenses. The only limitation of Bitcoin is that it is limited to those places that accept it as currency. However, it can also be exchanged for conventional currencies, such as the US dollar, Euro, Yen and Yuan. Therefore, Bitcoin is a currency or form of money, and investors wishing to invest in BTCST provided an investment of money.”

Bitcoin investments “meet the definition of investment contract, and as such, are securities,” the judge added….

Despite Shavers’ argument, Mazzant weighed in this week with an opinion that’s not only quite the contrary, but could have widespread repercussions in the world of Bitcoin.

“It is clear that Bitcoin can be used as money,” Mazzant wrote. “It can be used to purchase goods or services, and as Shavers stated, used to pay for individual living expenses. The only limitation of Bitcoin is that it is limited to those places that accept it as currency. However, it can also be exchanged for conventional currencies, such as the US dollar, Euro, Yen and Yuan. Therefore, Bitcoin is a currency or form of money, and investors wishing to invest in BTCST provided an investment of money.”Bitcoin investments “meet the definition of investment contract, and as such, are securities,” the judge added….

“It is clear that Bitcoin can be used as money,” Mazzant wrote. “It can be used to purchase goods or services, and as Shavers stated, used to pay for individual living expenses. The only limitation of Bitcoin is that it is limited to those places that accept it as currency. However, it can also be exchanged for conventional currencies, such as the US dollar, Euro, Yen and Yuan. Therefore, Bitcoin is a currency or form of money, and investors wishing to invest in BTCST provided an investment of money.”

Bitcoin investments “meet the definition of investment contract, and as such, are securities,” the judge added….

Bitcoin investments “meet the definition of investment contract, and as such, are securities,” the judge added….

Consider This article back in March of this year:

US Begins Regulating BitCoin, Will Apply “Money Laundering” Rules To Virtual Transactions

Last November, in an act of sheer monetary desperation, the ECB issued an exhaustive, and quite ridiculous, pamphlet titled “Virtual Currency Schemes” in which it mocked and warned about the “ponziness” of such electronic currencies as BitCoin. Why a central bank would stoop so “low” to even acknowledge what no “self-respecting” (sic) PhD-clad economist would even discuss, drunk and slurring, at cocktail parties, remains a mystery to this day. However, that it did so over fears the official artificial currency of the insolvent continent, the EUR, may be becoming even more “ponzi” than the BitCoins the ECB was warning about, was clear to everyone involved who saw right through the cheap propaganda attempt. Feel free to ask any Cypriot if they would now rather have their money in locked up Euros, or in “ponzi” yet freely transferable, unregulated BitCoins.

For the answer, we present the chart showing the price of BitCoin in EUR terms since the issuance of the ECB’s paper:

As central banks have been able to manipulate the price of precious metals for decades, using a countless plethora of blatant and not so blatant trading techniques, whether involving “banging the close”, abusing the London AM fix, rehypothecating and leasing out claims on gold to short and re-short the underlying, creating paper gold exposure out of thin air with which to suppress deliverable prices, or simply engaging in any other heretofore unknown illegal activity, the parabolic surge in gold and silver has, at least for the time being – and especially since the infamous, and demoralizing May 1, 2011 silver smackdown – lost its mojo.

But while precious metals have been subject to price manipulation by the legacy establishment, even if ultimately the actual physical currency equivalent asset, its “value” naively expressed in some paper currency, may be in the possession of the beholder, to date no price suppression or regulation schemes of virtual currencies existed.

It was thus only a matter of time before the same establishment was forced to make sure that money leaving the traditional M0/M1/M2/M3 would not go into alternative electronic currency venues, but would instead be used to accelerate the velocity of the money used by the legacy, and quite terminal, monetary system.

After all, what if not pushing savers to spend, spend, spend and thus boost the money in circulation, was the fundamental purpose of the recent collapse in faith in savings held with European banks?

So, as we had long expected, the time when the global Keynesian status quo refocused its attention from paper gold and silver prices, to such “virtual” currencies as BitCoin has finally arrived.

The WSJ reports that, “the U.S. is applying money-laundering rules to “virtual currencies,” amid growing concern that new forms of cash bought on the Internet are being used to fund illicit activities. The move means that firms that issue or exchange the increasingly popular online cash will now be regulated in a similar manner as traditional money-order providers such as Western Union Co. They would have new bookkeeping requirements and mandatory reporting for transactions of more than $10,000. Moreover, firms that receive legal tender in exchange for online currencies or anyone conducting a transaction on someone else’s behalf would be subject to new scrutiny, said proponents of Internet currencies.

And just like that, there goes a major part of the allure of all those virtual currencies such as BitCoin that consumers had turned to, and away from such rapidly devaluing units of exchange as the dollar and euro. Because if there was one medium of exchange that was untouched, unregulated, and unmediated by the US government and other authoritarian, despotic regimes around the insolvent “developed world”, it was precisely transactions involving BitCoin……

Last November, in an act of sheer monetary desperation, the ECB issued an exhaustive, and quite ridiculous, pamphlet titled “Virtual Currency Schemes” in which it mocked and warned about the “ponziness” of such electronic currencies as BitCoin. Why a central bank would stoop so “low” to even acknowledge what no “self-respecting” (sic) PhD-clad economist would even discuss, drunk and slurring, at cocktail parties, remains a mystery to this day. However, that it did so over fears the official artificial currency of the insolvent continent, the EUR, may be becoming even more “ponzi” than the BitCoins the ECB was warning about, was clear to everyone involved who saw right through the cheap propaganda attempt. Feel free to ask any Cypriot if they would now rather have their money in locked up Euros, or in “ponzi” yet freely transferable, unregulated BitCoins.

For the answer, we present the chart showing the price of BitCoin in EUR terms since the issuance of the ECB’s paper:

As central banks have been able to manipulate the price of precious metals for decades, using a countless plethora of blatant and not so blatant trading techniques, whether involving “banging the close”, abusing the London AM fix, rehypothecating and leasing out claims on gold to short and re-short the underlying, creating paper gold exposure out of thin air with which to suppress deliverable prices, or simply engaging in any other heretofore unknown illegal activity, the parabolic surge in gold and silver has, at least for the time being – and especially since the infamous, and demoralizing May 1, 2011 silver smackdown – lost its mojo.

But while precious metals have been subject to price manipulation by the legacy establishment, even if ultimately the actual physical currency equivalent asset, its “value” naively expressed in some paper currency, may be in the possession of the beholder, to date no price suppression or regulation schemes of virtual currencies existed.

It was thus only a matter of time before the same establishment was forced to make sure that money leaving the traditional M0/M1/M2/M3 would not go into alternative electronic currency venues, but would instead be used to accelerate the velocity of the money used by the legacy, and quite terminal, monetary system.

After all, what if not pushing savers to spend, spend, spend and thus boost the money in circulation, was the fundamental purpose of the recent collapse in faith in savings held with European banks?

So, as we had long expected, the time when the global Keynesian status quo refocused its attention from paper gold and silver prices, to such “virtual” currencies as BitCoin has finally arrived.

The WSJ reports that, “the U.S. is applying money-laundering rules to “virtual currencies,” amid growing concern that new forms of cash bought on the Internet are being used to fund illicit activities. The move means that firms that issue or exchange the increasingly popular online cash will now be regulated in a similar manner as traditional money-order providers such as Western Union Co. They would have new bookkeeping requirements and mandatory reporting for transactions of more than $10,000. Moreover, firms that receive legal tender in exchange for online currencies or anyone conducting a transaction on someone else’s behalf would be subject to new scrutiny, said proponents of Internet currencies.

And just like that, there goes a major part of the allure of all those virtual currencies such as BitCoin that consumers had turned to, and away from such rapidly devaluing units of exchange as the dollar and euro. Because if there was one medium of exchange that was untouched, unregulated, and unmediated by the US government and other authoritarian, despotic regimes around the insolvent “developed world”, it was precisely transactions involving BitCoin……

Last November, in an act of sheer monetary desperation, the ECB issued an exhaustive, and quite ridiculous, pamphlet titled “Virtual Currency Schemes” in which it mocked and warned about the “ponziness” of such electronic currencies as BitCoin. Why a central bank would stoop so “low” to even acknowledge what no “self-respecting” (sic) PhD-clad economist would even discuss, drunk and slurring, at cocktail parties, remains a mystery to this day. However, that it did so over fears the official artificial currency of the insolvent continent, the EUR, may be becoming even more “ponzi” than the BitCoins the ECB was warning about, was clear to everyone involved who saw right through the cheap propaganda attempt. Feel free to ask any Cypriot if they would now rather have their money in locked up Euros, or in “ponzi” yet freely transferable, unregulated BitCoins.

For the answer, we present the chart showing the price of BitCoin in EUR terms since the issuance of the ECB’s paper:

As central banks have been able to manipulate the price of precious metals for decades, using a countless plethora of blatant and not so blatant trading techniques, whether involving “banging the close”, abusing the London AM fix, rehypothecating and leasing out claims on gold to short and re-short the underlying, creating paper gold exposure out of thin air with which to suppress deliverable prices, or simply engaging in any other heretofore unknown illegal activity, the parabolic surge in gold and silver has, at least for the time being – and especially since the infamous, and demoralizing May 1, 2011 silver smackdown – lost its mojo.

But while precious metals have been subject to price manipulation by the legacy establishment, even if ultimately the actual physical currency equivalent asset, its “value” naively expressed in some paper currency, may be in the possession of the beholder, to date no price suppression or regulation schemes of virtual currencies existed.

It was thus only a matter of time before the same establishment was forced to make sure that money leaving the traditional M0/M1/M2/M3 would not go into alternative electronic currency venues, but would instead be used to accelerate the velocity of the money used by the legacy, and quite terminal, monetary system.

After all, what if not pushing savers to spend, spend, spend and thus boost the money in circulation, was the fundamental purpose of the recent collapse in faith in savings held with European banks?

So, as we had long expected, the time when the global Keynesian status quo refocused its attention from paper gold and silver prices, to such “virtual” currencies as BitCoin has finally arrived.

The WSJ reports that, “the U.S. is applying money-laundering rules to “virtual currencies,” amid growing concern that new forms of cash bought on the Internet are being used to fund illicit activities. The move means that firms that issue or exchange the increasingly popular online cash will now be regulated in a similar manner as traditional money-order providers such as Western Union Co. They would have new bookkeeping requirements and mandatory reporting for transactions of more than $10,000. Moreover, firms that receive legal tender in exchange for online currencies or anyone conducting a transaction on someone else’s behalf would be subject to new scrutiny, said proponents of Internet currencies.

And just like that, there goes a major part of the allure of all those virtual currencies such as BitCoin that consumers had turned to, and away from such rapidly devaluing units of exchange as the dollar and euro. Because if there was one medium of exchange that was untouched, unregulated, and unmediated by the US government and other authoritarian, despotic regimes around the insolvent “developed world”, it was precisely transactions involving BitCoin……

Last November, in an act of sheer monetary desperation, the ECB issued an exhaustive, and quite ridiculous, pamphlet titled “Virtual Currency Schemes” in which it mocked and warned about the “ponziness” of such electronic currencies as BitCoin. Why a central bank would stoop so “low” to even acknowledge what no “self-respecting” (sic) PhD-clad economist would even discuss, drunk and slurring, at cocktail parties, remains a mystery to this day. However, that it did so over fears the official artificial currency of the insolvent continent, the EUR, may be becoming even more “ponzi” than the BitCoins the ECB was warning about, was clear to everyone involved who saw right through the cheap propaganda attempt. Feel free to ask any Cypriot if they would now rather have their money in locked up Euros, or in “ponzi” yet freely transferable, unregulated BitCoins.

For the answer, we present the chart showing the price of BitCoin in EUR terms since the issuance of the ECB’s paper:

As central banks have been able to manipulate the price of precious metals for decades, using a countless plethora of blatant and not so blatant trading techniques, whether involving “banging the close”, abusing the London AM fix, rehypothecating and leasing out claims on gold to short and re-short the underlying, creating paper gold exposure out of thin air with which to suppress deliverable prices, or simply engaging in any other heretofore unknown illegal activity, the parabolic surge in gold and silver has, at least for the time being – and especially since the infamous, and demoralizing May 1, 2011 silver smackdown – lost its mojo.

But while precious metals have been subject to price manipulation by the legacy establishment, even if ultimately the actual physical currency equivalent asset, its “value” naively expressed in some paper currency, may be in the possession of the beholder, to date no price suppression or regulation schemes of virtual currencies existed.

It was thus only a matter of time before the same establishment was forced to make sure that money leaving the traditional M0/M1/M2/M3 would not go into alternative electronic currency venues, but would instead be used to accelerate the velocity of the money used by the legacy, and quite terminal, monetary system.

After all, what if not pushing savers to spend, spend, spend and thus boost the money in circulation, was the fundamental purpose of the recent collapse in faith in savings held with European banks?

So, as we had long expected, the time when the global Keynesian status quo refocused its attention from paper gold and silver prices, to such “virtual” currencies as BitCoin has finally arrived.

The WSJ reports that, “the U.S. is applying money-laundering rules to “virtual currencies,” amid growing concern that new forms of cash bought on the Internet are being used to fund illicit activities. The move means that firms that issue or exchange the increasingly popular online cash will now be regulated in a similar manner as traditional money-order providers such as Western Union Co. They would have new bookkeeping requirements and mandatory reporting for transactions of more than $10,000. Moreover, firms that receive legal tender in exchange for online currencies or anyone conducting a transaction on someone else’s behalf would be subject to new scrutiny, said proponents of Internet currencies.

And just like that, there goes a major part of the allure of all those virtual currencies such as BitCoin that consumers had turned to, and away from such rapidly devaluing units of exchange as the dollar and euro. Because if there was one medium of exchange that was untouched, unregulated, and unmediated by the US government and other authoritarian, despotic regimes around the insolvent “developed world”, it was precisely transactions involving BitCoin……

Let me give you a hint: there are NO Banks or Credit Unions or financial institutions in North America (actually, the entire world) that are NOT completely controlled by the Federal Reserve (excluding Iran, North Korea, and Cuba of course, which are the last three free standing Central Banks). All those purported “Sovereign” groups (First Nations or other wise) that have their own “Bank/s” are ALL controlled by the Federal Reserve. Yes, many of them deal with financial institutions in Switzerland…. but the FED controls all of those Swiss banks so it really doesn’t make any difference, does it? Same with currencies….. Bitcoin has been sucked into the Federal Reserve and US Treasury. Nope- I don’t have any links to prove that, but I can guarantee that it’s happened.

Well that’s it for this moment. I’ll be back in a bit with lots more to talk about!!

Leave a Reply