(Zero Hedge) A synchronized global slowdown, with no end in sight, has spooked some of the wealthiest investors around the world, according to a new survey from UBS Wealth Management, seen by Bloomberg. UBS polled wealthy investors, who are preparing for a significant stock market correction by the end of next year.

Related The Boom Turns Into A Bust – Here Are 14 Signs That The US. Economy Is Steadily Weakening

by Staff Writer, November 12th, 2019

In the survey of more than 3,400 high net wealth respondents, 25% said they’ve sold risk assets, such as equities, commodities, and high-yield bonds, and have transitioned into cash. The synchronized global slowdown, coupled with a US-China trade war, were some of the greatest concerns of respondents.

“The rapidly changing geopolitical environment is the biggest concern for investors around the world,” said Paula Polito, client strategy officer at UBS GWM, in a statement. “They see global interconnectivity and reverberations of change impacting their portfolios more than traditional business fundamentals, a marked change from the past.”

Buy Book The Grip of Death: A Study of Modern Money, Debt Slavery, and Destructive Economics

About 80% of the respondents expect volatility to increase through 2020, and 55% believe a market plunge could occur before Q4 2020.

Worse, 60% of respondents expected to raise cash levels in the coming quarters (i.e., sell stocks).

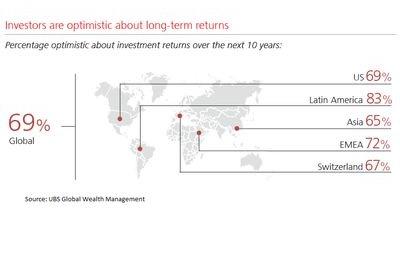

Most respondents said the added caution is due to a possible blowoff top in global equity markets. About 70% of respondents are optimistic through 2030.

“The challenge is that they seem to want to respond” to short-term uncertainty “by really shortening their time horizons and shifting to assets like cash that are safe,” said Michael Crook, a managing director on the investment strategy team. Though with many of these people investing on a time horizon across decades and for future generations, that “seems like a mismatch.”

Buy Book Game of Loans: The Rhetoric and Reality of Student Debt (The William G. Bowen Series)

And while most respondents said they’re preparing for market turbulence in the short term, many should rethink their US outlook for the next decade. Teddy Vallee, CIO of Pervalle Global, shows that the “US is dead money for the next 10 yrs.”

US is dead money for next 10 yrs. $SPX pic.twitter.com/m3WszBeg8c

— Teddy Vallee (@TeddyVallee) October 28, 2019

Vallee suggests that today’s parabolic up moves in stocks could actually be blowoff tops, similar to what was seen in Nikkei 225 in late 1989/90.

Stillness in the Storm Editor: Why did we post this?

The news is important to all people because it is where we come to know new things about the world, which leads to the development of more life goals that lead to life wisdom. The news also serves as a social connection tool, as we tend to relate to those who know about and believe the things we do. With the power of an open truth-seeking mind in hand, the individual can grow wise and the collective can prosper.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammar mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

Dont keep your cash in a bank, for when they close and use your accounts to pay off their debts, they wont even say thank you.. …