(Zero Hedge) As everyone knows by now, after the market closed on Monday, the US Treasury unexpectedly named China a currency manipulator, which naturally will be viewed as an escalation of the trade war and exacerbate the market sell-off, even if the PBOC briefly limited the selloff overnight by fixing the yuan slightly higher than expected (don’t expect this calm to last).

by Staff Writer, August 6th, 2019

While symbolically significant given that this designation was last used 25 years ago, in and of itself this act is unlikely to result in actions on the scale of recent tariffs or other US sanctions.

So what does it mean to be a named a manipulator?

Below we share the quick take of Standard Chartered’s Steven Englander.

Consider the relevant portions of Section 3004 of the Omnibus Trade and Competitiveness Act of 1988. Being designated a manipulator means “…the Secretary of the Treasury shall take action to initiate negotiations… in the International Monetary Fund or bilaterally, for the purpose of ensuring that such countries regularly and promptly adjust the rate of exchange… to eliminate the unfair advantage.” Under Section 701 of the Trade Facilitation and Trade Enforcement Act of 2015, “If… one year after the commencement of enhanced bilateral engagement… country has failed to adopt appropriate policies to correct the undervaluation… the President shall take one or more of the following actions: (A) Prohibit the Overseas Private Investment Corporation from approving any new financing… (B) prohibit the Federal Government from procuring… goods or services from that country… (C) instruct the United States Executive Director of the International Monetary Fund to call for additional rigorous surveillance of the macroeconomic and exchange rate policies of that country… (D) instruct the United States Trade Representative to take into account, in consultation with the Secretary in assessing whether to enter into a bilateral or regional trade agreement with that country…”

It may be embarrassing to be named a manipulator, but the consequences are not severe. However, a year of negotiations followed by the relatively modest sanctions listed above may work politically for the US administration if it is unable to cut a trade deal with China in the coming months.

In market terms, the designation, however meretricious, will likely be seen as a further ramping up of the trade dispute and possibly leading to some reaction by China.Naming China a manipulator, given the absence of teeth to the law, should have less substantive impact on activity and asset markets than a tariff increase, but it will likely add to asset market pressures in the short term and pressure the Fed on additional easing.

Fed easing is likely to be the most effective long-term means of weakening the USD; the US administration’s actions may be in part driven by the desire to add pressure on the Fed. The immediate asset market response is likely to be added downward pressure on equities, bond yields and risk-correlated currencies.

Buy Book Bankruptcy of Our Nation (Revised and Expanded)

And here is the take of Goldman’s FX strategist Andrew Tilton:

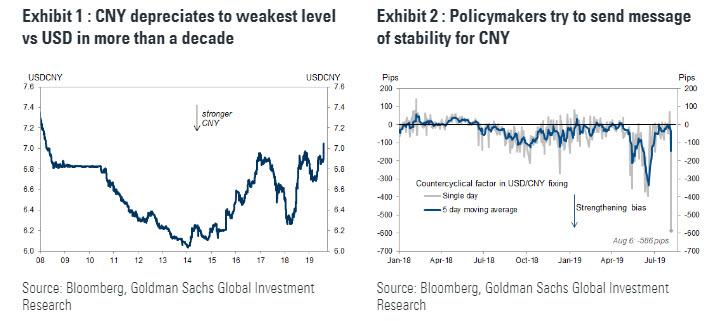

The US Treasury has designated China a “currency manipulator” under section 3004 of the Omnibus Trade and Competitiveness Act of 1988. This follows Monday’s weakening of the Chinese renminbi through 7 to the US dollar, the first time the renminbi has traded through this threshold in more than a decade (Exhibit 1). The Treasury last used the currency manipulator designation 25 years ago (China was also designated from 1992-94).

While the move represents a symbolic escalation of the trade conflict, as a practical matter we do not expect it to have major consequences on its own. The US administration has already levied substantial tariffs on Chinese goods, among other actions. The Treasury statement says only that Secretary Mnuchin “will engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions.” (In this regard, we note the IMF’s chief economist recently indicated that “China’s external position moved to become more broadly in line with fundamentals in 2018”, in part due to “greater exchange rate flexibility and the associated real appreciation over the last decade”.)

Ironically, the latest actions by Chinese policymakers appear to be aimed at limiting the degree of CNY depreciation that takes place. Yesterday’s statement by the PBOC includes language that downplays the 7 threshold, implying that the currency could potentially re-strengthen through this threshold, and would not necessarily depreciate sharply further. We view this as broadly consistent with our own forecasts (USDCNY 7.05 in three months, around the current level), although near-term risks still seem skewed towards weakness. We note the PBOC also employed the largest-ever “countercyclical factor” this morning (Exhibit 2 below), with the daily CNY fixing 586 pips stronger than a formula using the previous day’s close and overnight broad USD move would suggest – a signal that policymakers want to avoid a sharp depreciation.

The economy is a general term describing various exchanges of money, goods, and services between individuals, groups, and nations. The Deep State employ elaborate methods to manipulate the economy for the purpose of controlling human life, specifically by making it difficult to access goods and services that improve quality of life. The preceding information reveals news or research related to the economy at some level. This information is important to understand because it is one facet of the global control system. Truly free people have the ability to exchange their creative works (goods and services), which allows them to gain increased abundance over time due to innovation, technological advancement, and frugality. Thus, but understanding the economy and how money works, which is something most people do not understand, social systems of freedom can be developed. An individual’s freedom is only as effective as the environment within which they express their rights. As such, the individual is encouraged to gain deep knowledge of the law, and the expression of rights, which in a grand sense, is the economy at all levels—the exchange of ideas, energy, and resources. Once a group of individuals learns how to unite to protect their rights and resources (e.g. a nation or country) they can defend themselves from Deep State manipulation if they can guard against divide and conquer tactics and forme a truly lawful body politic.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammar mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

https://www.zerohedge.com/news/2019-08-06/what-are-consequences-being-named-currency-manipulator

Leave a Reply