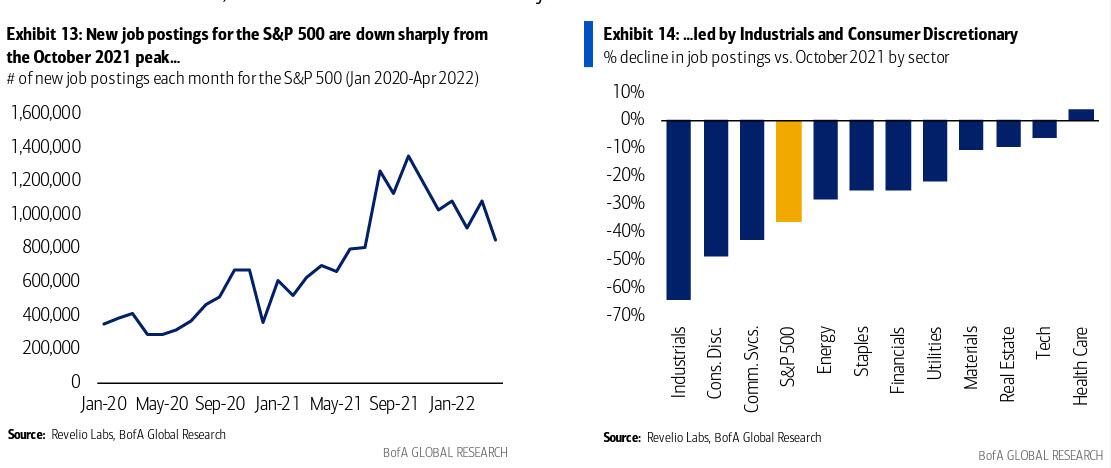

(Activist Post) Last weekend we showed something remarkable (or delightful, if one is a stock bull): with the US economy on the verge of recession, with inflation topping, with the housing market about to crack, the last pillar holding up the US economy (and preventing the Fed from continuing its tightening plans beyond the summer), the job market, had just hit a brick wall as revealed by real-time indicators – such as Revello’s measure of total job postings – which plunged by 22.5%, the biggest change on record (we also listed several other labor market metrics confirming that the job market was about to crater).

Related Capitol Hill Crisis Pregnancy Center Attacked by Pro-Abortion Radicals

by Staff Writer, May 28th, 2022

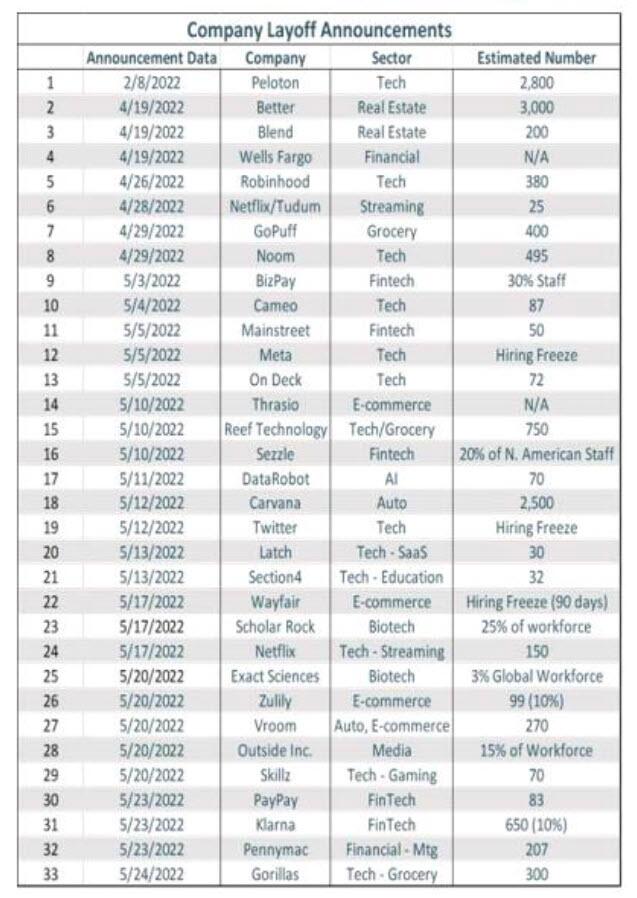

Fast forward to today when one day after we found that initial jobless claims continue to rise after hitting a generational low in March, and as company after company is warning that it will freeze hiring amid a historic profit margin crunch – if not announce outright layoff plans – Piper Sandler has compiled all the recent company mass layoff announcements. They are, in a word, startling.

Commenting on the surge in layoffs, Piper Sandler’s chief economist Nancy Lazar says that “post-covid rightsizing means that lots more layoffs are coming” and adds that “many companies overhired and overpaid during the Covid crisis.” Lazar also points out the obvious, that “the stay-at-home bubble was a bubble, and not a ‘new paradigm’ of goods consumption” which means that “a right-sizing cycle is coming, with weaker growth in jobs and wages.”

Here are the stunning implications according to Piper Sandler:

- We could see a million layoffs or more, as many goods sectors that benefited from the pandemic now realize they added too much capacity (as involuntary admissions make clear).

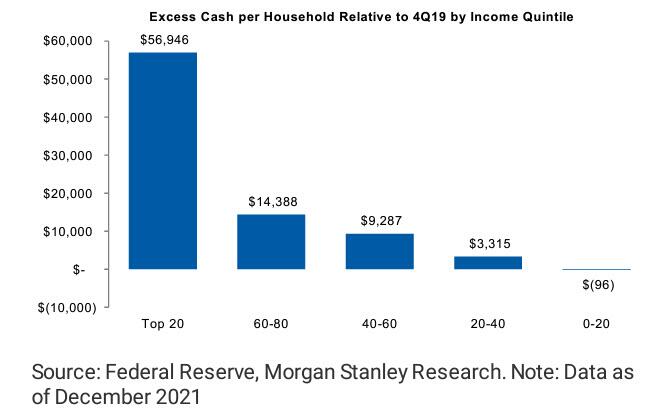

- Low-income workers – who enjoyed the hottest wage gains during the crisis – are now most at risk of layoffs, with remaining job holders to see much slower wage growth.

- Payrolls gains are poised to downshift to just 100k/month on average in the second half of the year, from about 515k/month through April.

While the above implications are startling for the US economy as a whole, they are especially bad for America’s poorest quintile which, according to Morgan Stanley calculations, now have less “excess cash” than they did pre-covid. In other words, the poorest 20% income quintile is now poorer than it was before Biden’s massive stimmy bonanza. And with every passing month, more quintile will get dragged underneath.

Of course, the US labor market doesn’t need to go into all-out cardiac arrest — a sharp drop in wage growth should do it. And sure enough, according to a Bloomberg report today, after handing out hefty salary increases over the past year, companies are now becoming more cautious with their cash over concern further big payouts will eat into profits, according to staffing companies, business owners and recent surveys.

“We’ve reached a level of wage inflation where employers are going to say, ‘I’ve done as much as I can,’” said Jonas Prising, chief executive officer of ManpowerGroup Inc., the Milwaukee-based staffing company that serves more than 100,000 clients worldwide. “‘My consumers and customers aren’t going to accept me passing these costs on any further, so we need to start to mitigate them.’”

Burning Glass Institute Chief Economist Gad Levanon said the US is transitioning from a pandemic-driven job market — where many Americans weren’t actively seeking work due to fears of the virus and related issues — to one that is more traditionally tight because unemployment is low. “Every company still needs people but they don’t need hundreds of people,” said Tom Gimbel, chief executive officer of Chicago-based employment agency LaSalle Network. “They’re being choosier about who they’re hiring than they were six months ago.”

Beveridge Well Drilling Inc. is among those feeling the pinch. The Nebraska-based company is offering an hourly wage of $16.50 for manual labor, up from $12 about a year ago. But even with “100%” health care benefits and other generous perks, it can’t fill all the open slots, vice president of construction Brandon Jones said.

And while the firm could bump up its offers to about $18 an hour, that’s “about as high as we feel we can do” against the backdrop of rising fuel and supply costs, Jones said.

All of which begs the question: yes, Biden may be terrified about soaring inflation….

Biden about to find out what polls worse: recession and bear market or runaway inflation.

— zerohedge (@zerohedge) May 20, 2022

… but how long will he tolerate an economy (and how long will an economic tolerate him) where millions are not only about to see their wages “revert back to normal” if they are lucky, while many other millions are about to lose their jobs.

As for the Fed, well with the Citi US Eco surprise index already crashing…

… one can only imagine where it will go not if but when we get a negative payrolls print in one of the coming months, and what that will do to the Fed’s hiking plans.

10 times more effective than ribavirin against Herpes (HSV1, HSV2), Swine flu (H1N1), Bird flu (H1N4), Pox (cowpox). Studied by the DoD for the Bioshield program. Get your Agarikon biodefense from Ascent Nutrition, one of the most pure and potent in the industry. Save 10% and get free shipping with a subscription!“I felt like I was getting a cold, but Agarikon stopped it in its tracks.”

Organic AGARIKON fights Viruses & Bio-warfare, and much more!

Stillness in the Storm Editor: Why did we post this?

The news is important to all people because it is where we come to know new things about the world, which leads to the development of more life goals that lead to life wisdom. The news also serves as a social connection tool, as we tend to relate to those who know about and believe the things we do. With the power of an open truth-seeking mind in hand, the individual can grow wise and the collective can prosper.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammatical mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

Support our work! (Avoid Big Tech PayPal and Patreon)DIRECT DONATION

Leave a Reply