The world economy is based on the sand foundation of usury, which was considered a sin and tool of covert warfare for thousands of years.

The rich rules over the poor,

And the borrower is servant to the lender. Proverbs 22:7

Let me issue and control a nation’s money and I care not who writes its laws — Attributed to Mayer Amschel Rothschild

The world financial system seems complex but it is actually very simple: a cabal of bankers has conquered the world by lending people and governments money that does not exist and charging interest on it. No lasting economic recovery or increased standard of living is possible for the majority unless usury and the political power of bankers are abolished.

History

Usury is the lending of money with interest.

Historically, many cultures regarded the charging of interest for loans as sinful. Some of the earliest known condemnations of usury come from the Vedic texts of India. Similar condemnations are found in the religious texts from Buddhism, Judaism, Christianity, and Islam. At times, many nations from ancient China to ancient Greece to ancient Rome have outlawed loans with any interest. Though the Roman Empire eventually allowed loans with carefully restricted interest rates, the Christian church in medieval Europe banned the charging of interest at any rate.

Usury has been denounced by a number of religious leaders and philosophers in the ancient world, including Moses, Plato, Aristotle, Cato, Cicero, Seneca, Jesus, Aquinas, Martin Luther, Muhammad, Gautama Buddha.

The ancient Israelites called usury “a bite.” It is like the slow poison of a serpent: “Usury does not all at once destroy a man or nation with, as it were, a bloody gulp. Rather, it slowly, sometimes nearly imperceptibly, subverts the victim’s constitution until he cannot prevent the fatal consequences even though he knows what is coming.”

The Old Testament “also classes the usurer with the shedder of blood, the defiler of his neighbor’s wife, the oppressor of the poor, the spoiler by violence, the violator of the pledge, the idolater.”

Indeed, the only time the Prince of Peace became violent is when he cleansed the temple of the money changers.

… Jesus went up to Jerusalem. In the temple he found those who were selling oxen and sheep and pigeons, and the money-changers sitting there. And making a whip of cords, he drove them all out of the temple, with the sheep and oxen. And he poured out the coins of the money-changers and overturned their tables.

Modern churches and synagogues remain silent in the face of this great evil. And today, the money changers (high-level bankers) have conquered the world with usury as their discreet weaponry. It is the fraudulent foundation of nearly all economies through debt-based currencies issued by privately owned central banks, fractional reserve lending, mortgages, credit cards, auto loans, business loans, and IMF loans.

The most powerful money changers have established think-tanks with their ill-gotten gains, such as the Council on Foreign Relations, Trilateral Commission and Bilderberg Group, which control all major political parties (The Establishment).

To free the world of debt slavery and a totalitarian world government run by money changers, it is necessary to understand these frauds.

Fractional Reserve Usury Banking

Banking was conceived in iniquity and was born in sin. The Bankers own the earth. Take it away from them, but leave them the power to create deposits, and with the flick of the pen they will create enough deposits to buy it all back again. However, take it away from them, and all the great fortunes like mine disappear, and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of Bankers and pay the cost of your own slavery, let them continue to create deposits. — Sir Josiah Stamp (President of the Bank of England in the 1920s).

Local and large banks profit tremendously from the fraud known as fractional reserve lending. While bankers wear suits and appear respectable, they actually prowl around like roaring lions seeking someone to devour. It works like this:

I set up a Rothbard Bank, and invest $1,000 of cash. Then I ‘lend out’ $10,000 to someone, either for consumer spending or to invest in his business. How can I ‘lend out’ far more than I have? Ahh, that’s the magic of the ‘fraction’ in the fractional reserve. I simply open up a checking account of $10,000 which I am happy to lend to Mr. Jones. Why does Jones borrow from me? Well, for one thing, I can charge a lower rate of interest than savers would. I don’t have to save up the money myself, but simply can counterfeit it out of thin air. Since demand deposits at the Rothbard Bank function as equivalent to cash, the nation’s money supply has just, by magic, increased by $10,000. The inflationary, counterfeiting process is under way.

To simplify, the inequity of the world’s banking system is the fact that the money borrowed from a bank is created out of nothing. On the other hand, the borrower must actually produce real goods and services to earn money to pay back the loan plus interest.

When bankers create money faster than the economy grows, the purchasing power of the dollar declines which is known as inflation. The majority of the population is competing like wild animals during a famine to earn enough money to pay their debts and feed their families.

Home Mortgage Usury

A thirty-year-debt-slave is someone that has a home mortgage. First, the debtor is borrowing money that was created out of nothing through fractional reserve lending.

Second, after years of making payments, the debtor may become injured or unemployed. The bank will then foreclose and sell the house. The bank will keep the proceeds of the sale and all the principal and interest that the borrower paid prior to going into default. Therefore, the borrower, who normally puts down only 20 percent (or much less) of the purchase price, bears almost 100% percent of the risk despite the fact that the bank decided to loan the other 80% (or more).

Second, after years of making payments, the debtor may become injured or unemployed. The bank will then foreclose and sell the house. The bank will keep the proceeds of the sale and all the principal and interest that the borrower paid prior to going into default. Therefore, the borrower, who normally puts down only 20 percent (or much less) of the purchase price, bears almost 100% percent of the risk despite the fact that the bank decided to loan the other 80% (or more).

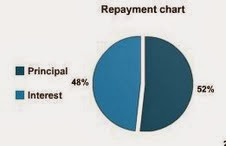

Third, the cost of a home loan is approximately double the amount borrowed when thirty years of interest payments are included. For example, if a borrower with good credit buys a $300,000 house and puts down 20 percent ($60,000), the borrower will borrow $240,000 from the bankers. The interest on a $240,000 loan at 5% (a historically low interest rate) over thirty years is $223,813.88. Therefore, the total cost of the $300,000 home is actually $463,813.88 (not including property taxes and insurance). Run the numbers yourself.

Credit Card Usury

Those who do not pay off their credit cards each month are slaves to usury. The average Annual Percentage Rate (APR) for a credit card in the United States is 14.95%. Credit cards with APRs above 20% are common.

In California, the Attorney General admits that limits on usury applicable to individuals making loans “do not apply to most lending institutions such as banks, credit unions, finance companies, pawn brokers, etc.”

Student Loan Usury

Approximately 40 million Americans have borrowed money to attend college. The average balance is close to $25,000. Nearly 50 percent of recent college graduates are unemployed or working in jobs that don’t require a college degree and pay accordingly. Students should know that in most cases student loans are not dischargeable in bankruptcy.

The Federal Reserve

In the United States, usury originates through the private Federal Reserve banking system. The Creature from Jekyll Island documents the following individuals drafted the Federal Reserve legislation in secret at Jekyll Island in 1910 (page 5 of the fourth edition):

- Paul Warburg, a partner of international investing giant Kuhn, Loeb & Company, a representative of the Rothschild banking dynasty in Europe, brother to Max Warburg who was head of the Warburg banking consortium in Germany.

- Senator Nelson Aldrich: business associate of J.P. Morgan and father-in-law to John D. Rockefeller, Jr.

- Frank Vanderlip: president of National City Bank of New York, one of the most powerful banks at the time, representing William Rockefeller and Kuhn, Loeb & Company.

- Henry Davidson: senior partner of J.P. Morgan.

- Charles Norton: president of J.P. Morgan’s First National Bank of New York.

- Abraham Andrew, Assistant Secretary of the U.S. Treasury.

- Benjamin Strong, head of J.P. Morgan’s Bankers Trust Company.

Woodrow Wilson signed the Federal Reserve Act into law on December 23, 1913. On that day, the U.S. government officially transferred its power to create money and regulate the value thereof to the world’s wealthiest private bankers. Furthermore, the U.S. government would now borrow money from private banks, enslaving its citizens with the national debt, rather than creating its own money interest free.

Former Federal Reserve Chairman Alan Greenspan publicly brags that the private banking cartel isabove the law and creates unlimited money out of nothing to loan its insolvent borrower, the U.S. government.

David Lang, a Federal Reserve employee, admits that the Federal Reserve is a private corporation that pays dividends to its undisclosed shareholders. The head of security at the San Antonio Federal Reserve also admits the institution is private.

So who receives dividends from owning shares of the private Federal Reserve? Charts created by the House Banking Committee Staff Report of August, 1976 reveal the following people and companies own shares in the Federal Reserve: Rothschilds, J.P. Morgan, the Warburgs banks, Lehman Brothers, Kuhn, Loeb & Company, Jacob Schiff, William Rockefeller, David Rockefeller/Chase Bank, and many others.

A more recent study found that Bank of America, JP Morgan Chase, Citigroup, Wells Fargo and HSBC now have the power of the Federal Reserve at their fingertips.

The IRS and Federal Reserve

Like the Federal Reserve, the IRS was created in 1913. The purpose of the IRS is to enslave citizens by stealing the value of their labor through collecting income taxes; by force if necessary.

Tax Freedom Day 2013 arrived on April 18 this year, meaning that Americans will work 108 days into the year, from January 1 to April 18, to earn enough money to pay this year’s combined 29.2% federal, state, and local tax bill.

In other words, on average, the IRS and other tax collectors steal over 3.5 months of each Americans’ labor time each year.

The private Federal Reserve is one of largest holders of U.S. government debt, owning approximately $1.794 trillion in U.S. Treasury securities. Much of the collected federal income taxes go towards paying interest on the national debt to the Fed for money that it created out of nothing and loaned to the government at interest. This unfortunate reality has been verified by G. Edward Griffin, Joe Plummer, IRS whistleblower, Joe Banister, and many others.

In part one of this article, we defined usury as the lending of money at interest. We examined the history of usury and how it was considered morally reprehensible for thousands of years, prior to becoming the sand foundation modern economies. We also examined the mastery of usury, how they create money out of nothing and use it as a silent weapon for control of humanity.

Here, we examine the crimes and iniquity made possible by usury; and practical solutions.

Banker Bailouts

After the largest banks made bad loans and foreclosed on over ten million (10,000,000) homes, often illegally by forging documents, the private Federal Reserve, which is owned by its member banks, bailed out the following banks with at least $16.9 trillion according to page 131 of the first GAO audit:

- Citigroup: $2.5 trillion ($2,500,000,000,000)

- Morgan Stanley: $2.04 trillion ($2,040,000,000,000)

- Merrill Lynch: $1.949 trillion ($1,949,000,000,000)

- Bank of America: $1.344 trillion ($1,344,000,000,000)

- Barclays PLC (United Kingdom): $868 billion ($868,000,000,000)

- Bear Sterns: $853 billion ($853,000,000,000)

- Goldman Sachs: $814 billion ($814,000,000,000)

- Royal Bank of Scotland (UK): $541 billion ($541,000,000,000)

- JPMorgan Chase: $391 billion ($391,000,000,000)

- Deutsche Bank (Germany): $354 billion ($354,000,000,000)

- UBS (Switzerland): $287 billion ($287,000,000,000)

- Credit Suisse (Switzerland): $262 billion ($262,000,000,000)

- Lehman Brothers: $183 billion ($183,000,000,000)

- Bank of Scotland (United Kingdom): $181 billion ($181,000,000,000)

- BNP Paribas (France): $175 billion ($175,000,000,000)

Banker Bail-Ins

Depositors at bailed-out Cyprus’ largest bank will lose 47.5 percent of their savings exceeding 100,000 euros ($132,000), the government said. The figure comes after Cyprus agreed on a 23 billion-euro ($30.5 billion) rescue package with its euro partners and the International Monetary Fund. In exchange for a 10 billion euro loan, deposits with more than the insured limit of 100,000 euros at the Bank of Cyprus and smaller lender Laiki were raided in a so-called bail-in to prop up the country’s teetering banking sector.

To simplify, those with depositors with over 100,000 euros had their money stolen by the bank they trusted with their deposit. The Cyprus government and IMF approved.

This will likely be the model new model for bailing out banks and should arrive in the U.S. by 2016.

International Usury

Almost half the world, three billion people, live on less than $2.50 per day and 80 percent of humanity lives on less than $10 per day. According to UNICEF, 22,000 children die each day due to poverty. That is, people are dying because a bank did not create enough digits on a computer screen (money) for them to buy food. This is no accident; it is the bankers’ move to depopulate the planet.

John Perkins wrote Confessions of an Economic Hit Man. During the 1970s he worked as an economic planner for an international consulting firm. In his book he describes how the globalists force the economic hegemony of the bankers, the IMF and World Bank on victim nations in the Third World.

Perkins’ job was to negotiate huge loans to third-world nations, loans that the bankers created out of nothing and which they knew the borrower nation could not repay. Once the borrower defaulted, the bankers would demand the nation’s natural resources and gain control of its political system and economy.

Several third-world leaders had integrity and refused to enslave their nations to the money changers. They also refused the cash, luxury, cocaine and hookers Perkins offered them on behalf of the bankers. Perkins says that leaders who would not play ball would eventually be overthrown in a CIA sponsored coup or assassinated.

As we saw with Libya, nations that refuse the West’s system of usury are often demonized in the media and overthrown.

It must also be noted that the largest banks even conspire to fix interest rates and interest swaps. The whole game is rigged.

Usury and the Drug Trade

The Masters of Usury also run the drug trade. A federal judge recently approved HSBC Holdings’ (Europe’s largest bank) $1.9 billion agreement with the U.S. to resolve charges that it enabled Latin American drug cartels to launder billions of dollars.

Wachovia Bank, now a unit of Wells Fargo, leads a list of firms that have moved dirty money forMexico’s narcotics cartels — helping a $39 billion trade that has killed more than 22,000 people since 2006.

“It’s the banks laundering money for the cartels that finances the tragedy,” says Martin Woods, director of Wachovia’s anti-money-laundering unit in London from 2006 to 2009. Woods says he quit the bank in disgust after executives ignored his documentation that drug dealers were funneling money through Wachovia’s branch network. “If you don’t see the correlation between the money laundering by banks and the 22,000 people killed in Mexico, you’re missing the point,” Woods says.

… Miami-based American Express Bank International paid fines in both 1994 and 2007 after admitting it had failed to spot and report drug dealers laundering money through its accounts. Drug traffickers used accounts at Bank of America in Oklahoma City to buy three planes that carried 10 tons of cocaine, according to Mexican court filings.

The Bank of Credit and Commerce International (BCCI) was also used to by the bankers’ political operatives to run the drug trade and finance CIA covert operations.

Fruits of Usury

In addition to 80% of the world living on less than $10 dollars per day, U.S. citizens are now beginning to understand the fruits of usury. Four out of 5 U.S. adults (80%) struggle with joblessness, near-poverty or reliance on welfare for at least parts of their lives, a sign of deteriorating economic security and an elusive American Dream.

Forty-seven million (47,000,000) Americans are on food stamps and more than 100 million Americans are enrolled in at least one welfare program run by the federal government.

Americans who were recipients of means-tested government benefits in 2011 outnumbered year-round full-time workers, according to data released this month by the Census Bureau. There were 108,592,000 people in the United States in the fourth quarter of 2011 who were recipients of one or more means-tested government benefit programs. Meanwhile, there were 101,716,000 people who worked full-time year round in 2011.

Today, 40 percent of U.S. workers make less than what a full-time minimum wage worker made in 1968. Back in 1968, the minimum wage in the United States was $1.60 an hour. That sounds small but when you adjust for inflation it is equivalent to at least $10.74 today.

War and Usury

As George Orwell taught us:

The primary aim of modern warfare is to use up the labor and goods produced by the machine without raising the general standard of living. From the moment when the machine first made its appearance it was clear to all thinking people that the need for human drudgery, and therefore to a great extent for human inequality, had disappeared. If the machine were used deliberately for that end, hunger, overwork, dirt, illiteracy, and disease could be eliminated within a few generations. But it was also clear that an all-round increase in wealth threatened the destruction — indeed, in some sense was the destruction — of a hierarchical society.

In a world in which everyone worked short hours, had enough to eat, lived in a house with a bathroom and a refrigerator, and possessed a car, the most obvious and perhaps the most important form of inequality would already have disappeared. If it once became general, wealth would confer no distinction. It was possible, no doubt, to imagine a society in which wealth, in the sense of personal possessions and luxuries, should be evenly distributed, while power remained in the hands of a small privileged caste. But in practice such a society could not long remain stable. For if leisure and security were enjoyed by all alike, the great mass of human beings who are normally stupefied by poverty would become literate and would learn to think for themselves; and when once they had done this, they would sooner or later realize that the privileged minority had no function, and they would sweep it away. In the long run, a hierarchical society was only possible on a basis of poverty and ignorance.

The cost of the U.S. wars in Iraq and Afghanistan will be $4 – $6 trillion. How many home mortgages could that pay off? How many hospitals built or pot holes filled? How many people fed? The purpose of war is clear.

Since the beginning of the Iraq War in 2003, the New York Federal Reserve shipped tens of billions of dollars to the government and central bank of Iraq, allegedly for reconstruction. Between 2003 and 2008, over $40 billion in cash was secretly shipped in trucks from the New York Federal Reserve compound in East Rutherford, New Jersey to Andrews Air Force Base outside of Washington, where they were then flown by military aircraft to Baghdad International Airport. In just the first two years, the shipments of dollar bills weighed a total of 363 tons.

But much of that money was stolen, misappropriated, and simply lost. Despite Congressional hearings and reports, nobody is saying exactly what happened to the bulk of the money. Most likely, the stolen fiat dollars, secretly printed out of thin air to fund the US government’s illegal war and senseless slaughter of Iraqis, went towards intricate contracting schemes and corrupt Iraqi and American officials.

Solutions to Usury – American System

Those who wish to defeat banker usury (a.k.a. globalization), improve the U.S. economy by creating 30-40 million living wage jobs, and return to a productive economy should strongly consider supporting the United Front Against Austerity (UFAA).

The United Front provides only proven policy solutions based on the traditional American System of Economics and is endorsed by author and Scholar, Webster Griffin Tarpley. It does not support either side of bankers’ false left vs. right divide-and-conquer scheme. Instead, the UFAA is a mass movement built on the most basic issues of economic survival. Action items include:

- Seize and Nationalize the Federal Reserve System

- 0% Federal Credit for Real Production and Farming to create 30 million jobs

- 1% Wall Street Sales Tax

- No Bank Bailouts

- No Investment Derivatives

- Student Loan Amnesty

- Stop All Home Foreclosures

- Rebuild the Nation’s Infrastructure

- Medicare for All Who Want It (as opposed to the Obama Care giveaway to insurance companies)

- Minimum Wage and Living Wage

- Tariffs on Imported Goods

- Ending the Wars and 0% Credit for Developing Countries

For the love of money is the root of all evil — II Timothy 6:10

Leave a Reply