Related 66% of the Economy is Already Electronic & 99% of Money is Electronic

Source – InvestmentResearchDynamics

by Dave Kranzler, January 5th, 2018

In reference to the mortgage and housing market collapse in 2008, Ben Bernanke wrote, “Clearly, many of us at the Fed, including me, underestimated the extent of the housing bubble and the risks it posed.” It’s hard to know if that statement is genuine or not, given that many of us saw the housing bubble that was developing as early as 2004.

The Federal Government’s low-to-no down payment programs via Fannie Mae, Freddie Mac, the FHA, VHA and USDA, combined with the hyper-promotion of cash-out refinancings (bigger 1st mortgages and/or second-lien mortgages) tell me that, once again, most people in this country believe – or rather, hope – that the outcome will be different this time.

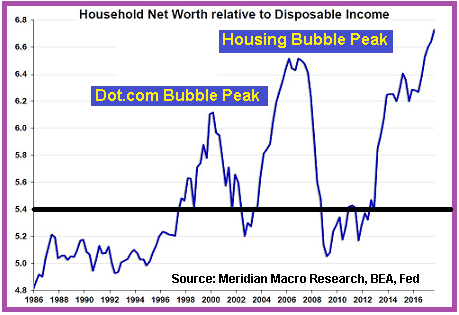

You’ll note the pattern that developed starting with the tech bubble era. Prior to the Clinton administration the Fed subtly intervened in the financial system by been printing money in excess of marginal wealth creation (GDP growth) once Nixon closed the gold window. But, in conjunction with the Greenspan Fed, the Government’s willingness to print money as an official policy tool took on a whole new dimension during the Clinton administration. Note: I’m not making a political judgment per se about the Clinton presidency, because the Fed’s ability to print money to prop up the stock market was established with Reagan’s Executive Order after the 1987 stock crash. You’ll note that the household net worth to income ratio began to rise at a sharp rate starting in mid-1994, which was when the Clinton-Rubin strong dollar policy was implemented. It’s also around the time that Greenspan began regularly printing money to address the series of financial problems that arose in the 1990’s.

The current ratio of household net worth to income is 6.75 – the highest household net worth to income ratio in history. It peaked around 6.5x in 2007 and 6.1x in early 2000. You’ll note that from 1986 to 1995 the ratio averaged just around 5.1x.

I wanted to present the two previous graphics and my accompanying analysis, in conjunction with the theme that “it is not different this time.” The extreme degree of household asset inflation relative to incremental GDP wealth output is yet another data-point indicating the high probability that a nasty stock market accident will occur sooner or later. To compound the severity of the problem, household asset inflation has been achieved primarily through massive credit creation. The amount of debt per home sold in this country currently is at a record level.

During this past week, the bullish sentiment of investors continued to soar. A record level of investor bullishness never ends well for the stock market. Speaking of which, there has been an interesting development in the Conference Board’s Consumer Confidence metrics. The headline-reported index showed an unexpected declined from 129.5 to 122.1 vs 128 expected. This is a big percentage drop and a big drop vs Wall Street’s crystal ball. However, while the “present situation” index hit its highest level since April 2001, the “expectations” – or “hope” – metric plunged from 113.3 to 99.1. It seems the current euphoria connected to the stock and housing markets is not expected to last.

The chart above shows the spread in consumer confidence between “present conditions” and “future conditions” (present conditions minus future conditions). A rising line indicates that future outlook (“hope”) is diverging negatively from present conditions. I’ve marked with red lines the peaks in this divergence which also happen to correlate with stock market tops (1979, 1987/1989, 2000).

The above commentary in an excerpt from the last issue of IRD’s Short Seller’s Journal. I think retail stocks are going to be hit relentlessly beginning some time this quarter. In fact, one stock I presented as a short in early December was down over 12% yesterday after it released an earnings warning. Some of the best SSJ short ideas in 2017 were retailers. You can learn more about this short-seller newsletter here: Short Seller’s Journal subscription information.

_________________________

Stillness in the Storm Editor’s note: Did you find a spelling error or grammar mistake? Do you think this article needs a correction or update? Or do you just have some feedback? Send us an email at [email protected] with the error, headline and url. Thank you for reading.

Leave a Reply