(Mitchell Nemeth) At around $22.5 trillion, the United States national debt sits at 106 percent of Gross Domestic Product (GDP). There is no disputing that this gigantic debt will someday become due and payable. However, there is hesitation among the political class as to what must be done to pay down and eliminate this debt.

debt

10 Myths About Government Debt — According to an Economics Professor

10 Myths About Government Debt — According to an Economics Professor

$220,000 For Every Man, Woman And Child – America Is Now 72 Trillion Dollars In Debt

(Michael Snyder) Are you ready to cough up $220,000 to pay your share? One of the reasons why a day of reckoning for the U.S. economy is inevitable is because we are in way too much debt.

We Have Spent $32 Million Per Hour on War Since 2001

(Stephanie Savell) This March marked the 16th anniversary of the U.S.-led invasion of Iraq. In 2003, President George W. Bush and his advisers based their case for war on the idea that Saddam Hussein, then dictator of Iraq, possessed weapons of mass destruction — weapons that have never been found. Nevertheless, all these years later, Bush’s “Global War on Terror” continues — in Iraq and in many other countries.

The True Size Of The U.S. National Debt, Including Unfunded Liabilities, Is 222 Trillion Dollars

(Michael Snyder) The United States is on a path to financial ruin, and everyone can see what is happening, but nobody can seem to come up with a way to stop it. According to the U.S. Treasury, the federal government is currently 22 trillion dollars in debt, and that represents the single largest debt in the history of the planet.

12 Statistics That Prove That The U.S. Is Facing A Consumer Debt Apocalypse

(Michael Snyder) In the entire history of the United States, consumers have never been in so much debt. And that would not be a crisis as long as the vast majority of us were regularly making our debt payments, but as you will see below delinquency levels are starting to rise to extremely alarming levels.

“Delinquency Is At Crisis Levels” – Student Loan Bubble Is About To Pop

(Zero Hedge) According to a new Bloomberg Report, the student debt crisis is about to take a turn for the worse, as the next generation of millennial graduates could be trapped in insurmountable debts.

Debt Rises: The Government Will Soon Spend More On Interest Than on The Military

(Mac Slavo) As debt and interest rates rise, the government is about to be in a disastrous situation. Very soon, they will spend more money paying interest on the national debt than they will on the bloated military budget.

Major Currencies All Over The World Are In “Complete Meltdown” As The $63 Trillion EM Debt Bubble Implodes

(Michael Synder) The wait for the next global financial crisis is over. Major currencies all over the planet are in a “death spiral”, many global stock markets are crashing, and economic activity is beginning to decline at a stunning rate in quite a few nations. Over the past 16 years, the emerging market debt bubble has grown from 9 trillion dollars to 63 trillion dollars. Yes, you read that correctly.

Bankrupt America: Bankruptcy Soars As The Country Grapples With An Unprecedented Debt Problem

(Michael Snyder) America, you officially have a debt problem, and I am not just talking about the national debt. Consumer bankruptcies are surging, corporate debt has doubled since the last financial crisis, state and local government debt loads have never been higher, and the federal government has been adding more than a trillion dollars a year to the federal debt ever since Barack Obama entered the White House.

Deceased and Still in Debt: The Student Loans that Don’t Get Forgiven

(The Guardian) A report published by the Brookings Institution analyzed data on the $1.3tn of US student loan debt and found that nearly 40% of borrowers could default on their student loans by 2023. Photograph: Seth Wenig/AP

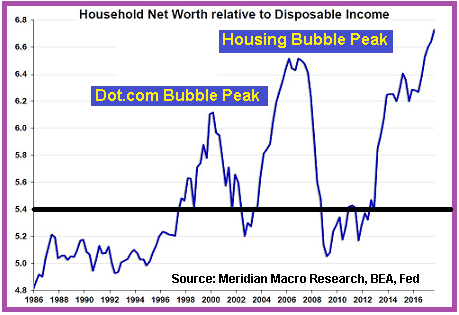

Ron Paul Warns That When The “Biggest Bubble In The History Of Mankind” Bursts It Could “Cut The Stock Market In Half”

(Michael Snyder) When this bubble finally bursts, will we witness the biggest stock market crash in U.S. history? “The bigger they come, the harder they fall” is a well used phrase, but I think that it is very appropriate in this case. From a low of 6,443.27 on March 6th, 2009, we have seen the Dow nearly quadruple in value since the last financial crisis.

Global Debt is Now an Insane $164 Trillion, but Who Exactly Do We Owe?

(Isaac Davis) If you’ve ever wondered why the world seems hopelessly fraught with endless conflict, ruled corrupt states, and bent on developing a never-ending supply of advanced weaponry, you’d need to understand the nature of our debt based economy.

The Four Most Dangerous Words in Investing

(Dave Kranzler) “This time it’s different.” That quote is from Sir John Templeton, a legendary investor who is considered the father of the modern mutual fund industry. For most of the month of December, I’ve been hearing ads from mortgage brokers who are promoting the idea of refinancing your house in order to take care […]

Parasitic Banking: Stealing from Future Generations, to Pay for the Present — Are Central Banks Nationalizing The Economy?

(Daniel Lacalle) The FT recently ran an article that states that “leading central banks now own a fifth of their governments’ total debt.” Related Modern Slavery | The True Reason behind the 40-Hour Work Week and Why Most People Are Economic Slaves Source – Zero Hedge by Daniel Lacalle, August 24th, 2017 The figures are staggering. Without […]