(Joe Hoft) People are reportedly lining up for hours in China to obtain money from their bank accounts in China. The large cities of Henan, Shanghai, and Dandong are three cities where the lines are long.

banks

HUGE: 102 Counties in Georgia Can’t Produce Drop Box Videos! NO SURVEILLANCE FOR OVER 181,000 BALLOTS!

(Jesse Martin) 102 Georgia Counties are unable to produce their drop box videos, meaning that there is no surveillance for over 181 thousand ballots.

Canadian Banks Say Freedom Convoy Backers’ Frozen Accounts Will Be Flagged for Life

(Jack Bingham) ‘There would be something in the file indicating a freeze had taken place,’ said the Canadian Bankers Association on Monday.

New York Attorney General Says Trump Organization Misled Banks, Tax Officials

(Just the News) New York AG Letitia James has been investigating Trump Organization financials for roughly two years.

WEF Warns: Global Warming To Disrupt Financial System, “Freeze” Bank Accounts

(Dr. C Advice) In its latest predictive propaganda, the World Economic Forum asks, “What if extreme weather FROZE your bank account?”

Central Banks & The Looming Financial Reckoning

(Willem Buiter) Across the advanced economies, central banks have rightly prioritized maintaining financial stability and supporting the real economy over fighting inflation with interest-rate hikes. But with financial fragility rife and public and private leverage at all-time highs, their next big test is coming.

Banks Around World Are Suffering Big Outages, Leaving Millions Of Customers In Lurch At Worst Possible Time

(NWO Report) Twenty banks (some suffering repeated outages), six countries (one in lockdown), five continents, tens of millions of unhappy customers.

Biden Administration Plan Would Have IRS Monitoring American’s Bank Accounts

(Carmine Sabia) Some Americans are furious with part of the $3.5 trillion spending plan from Joe Biden and the Democrats that would allow the IRS to monitor bank transactions.

Representative Banks Says Pelosi Was Most Responsible For January 6 Incident At Capitol

(Carmine Sabia) This could be the reason that House Speaker and California Rep. Nancy Pelosi did not want Rep. Jim Banks on her January 6 commission.

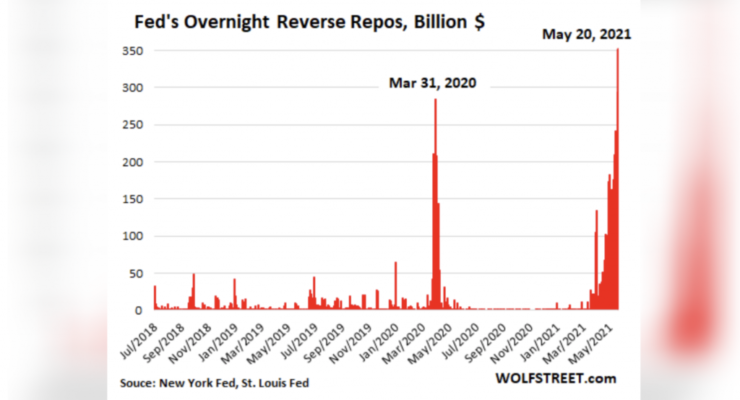

BANKS FAILING: Fed Struggling To Maintain Control, Silver About To Go Vertical?

(Noah) This is a Red Alert folks! Don’t say I didn’t warn you…. The overnight repo rate is a key indicator of a monetary system on the verge of collapse.

The Bankers Are Scared, Myanmar Changed Everything

(Vox Day) Myanmar is based beyond belief: As news of the military coup in Myanmar reached the halls of the Bank of Japan, staff raced to gather information about the ongoing developments.

Situation Update, Feb 1 – Populist Financial Uprising May Tear down the Entire Rigged System – Naturalnews.Com

(Mike Adams) The silver lining for the events of the last year is that huge numbers of people are awakening to fact that everything is rigged

PURGE: Banks Shutting Down Trump Accounts

(Steve Watson) Corporate and tech elite want Trump erased from history

The Circle Is Complete: Bank of Japan Joins Fed And ECB In Preparing Rollout Of Digital Currency

(Activist Post) First it was the Fed, then the ECB, and now the BOJ: the world’s central banks are quietly preparing to unleash digital currencies on an unsuspecting population in one final last-ditch attempt to spark inflation and do away with the current monetary orthodoxy which has failed to push living conditions for the masses higher (but most importantly, has failed to inflate away a growing mountain of insurmountable global debt).

Glass-Steagall Act

(Edward Morgan) The Glass-Steagall Act, part of the Banking Act of 1933, was landmark banking legislation that separated Wall Street from Main Street by offering protection to people who entrust their savings to commercial banks. Millions of Americans lost their jobs in the Great Depression, and one in four lost their life savings after more than 4,000 U.S. banks shut down between 1929 and 1933, leaving depositors with nearly $400 million in losses. The Glass-Steagall Act prohibited bankers from using depositors’ money to pursue high-risk investments, but the act was effectively undercut by looser restrictions in the deregulatory environment of the 1980s and 1990s.