(Zero Hedge) While the media is running around trying to pin headlines on the market moves from the Fed to the Omicron variant, the reality is that we are in the midst of mutual fund distribution season.

by Staff Writer, 2021

As Michael Lebowitz noted:

“We believe the rotation is not a sudden change in mindset but, likely the actions of mutual funds rebalancing their portfolios. Frequently at year-end mutual funds sell the winners which have become overweight positions and buy the losers which are below their proper weights. The large returns this year in certain sectors are making these actions more visible than normal.“

There is still some sloppiness likely over the next week, but such should theoretically provide investors the entry point for a “Santa Rally.”

But such should not be a surprise. In mid-November, we discussed the need to reduce risk against a potential correction. To wit:

Does this mean the market will experience a significant contraction? A pullback to the short-term moving averages would not be surprising and would encompass about a 3-4% drawdown.

What would cause such a correction? I don’t know. However, we are entering the mutual fund distribution season where fund managers need to distribution capital gains, dividends, and interest. Given that most funds are carrying very low cash levels, they will likely have to sell holdings to make those distributions.

Then, on the 23rd of November, we added:

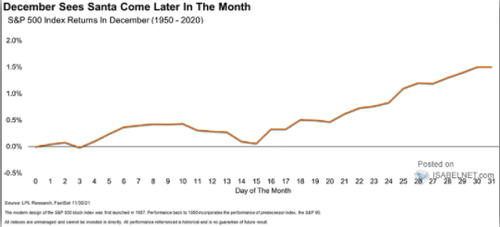

Investors’ “wish lists” are hung by the chimney with care, hopeful the “Santa Claus rally” will soon be there. While they remain “snug in their beds, the historical data dances in the heads.”

It certainly seems there is little to worry about.

Except that dip at the beginning of December.

But is the Omicron selloff over?

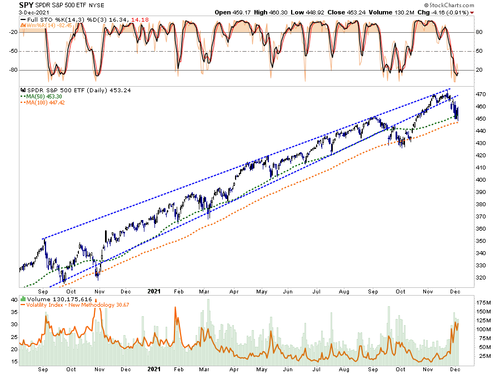

Omicron Selloff Tests 100-DMA

In the short term, selling pressure is starting to peak, and downside risk got reduced given the more extreme oversold conditions. As a result, volatility also spiked into excessive overbought levels, and the market held strong support at the 100-dma (orange line) on Friday.

We are using the more extreme oversold condition to add trading positions to our portfolio. The upside is likely limited to the bottom of the previous trend channel (blue dashed line) that began in 2020. However, we can take advantage of the rally back to those levels to bolster returns in portfolios.

Notably, any failure at that running lower trend line would be concerning. Such would suggest either a retest of current lows in January or, should that support fail, a very different market in 2022.

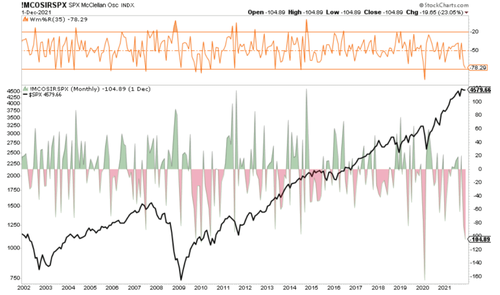

As noted above, while the media is frantic to pin sell-off on the “Omicron variant,” it is all quite normal within the context of historical trends. Lastly, another of our technical indicators, the McClellan Oscillator, confirms our analysis of a deeply oversold market.

Please note that I am consistently speaking of “short-term” opportunities.

While the current decline could strengthen back into a longer-term trend, we treat each increase in equity exposure as a trade until proven otherwise.

One mistake individuals make is trying to “buy the dip” and not respecting the potential for much more significant downside “dipping.”

Always maintain your stop-loss levels.

No Guarantees

The current “Omicron selloff” in the markets, combined with distributions, will leave portfolios “offsides” heading into year-end. As a result, portfolio managers will begin to “window dress” portfolios for year-end reporting around mid-month. As shown in the seasonal chart above, that “buying” is what typically pushes markets higher.

Such was a point I discussed with Charles Payne on Fox Business yesterday.

Had a lot of fun today talking shop with @cvpayne,

we are debating on #coal or #gifts in this year's #Christmas stockings. https://t.co/7mjlt5Ic7e— Lance Roberts (@LanceRoberts) December 3, 2021

Is a “Santa Claus” rally guaranteed? Absolutely not.

However, as noted, my Mom said I was a “good boy” this year, so I am hopeful I will get more than a “lump of coal” in my stocking.

Besides, I am not sure Santa Claus can afford coal this year anyway.

While I am optimistic as we head into year-end, I would be remiss not to point out the obvious risks.

Internal Measures Suggests Risk Remains Present

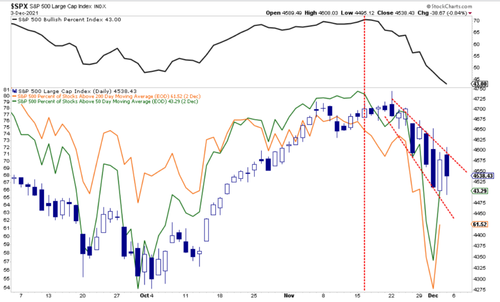

Over the last few weeks, we have discussed the continuing deterioration of market internals from breadth to volume to expanding new lows. At the same time, while market internals weakened, broad markets continued to rise. As shown, stocks trading above their 50- and 200-dma and the bullish percent index turned down in mid-November. Such suggested the market was at risk of a correction; all that was needed was an event to shift psychology.

That’s how you get the “Omicron selloff.”

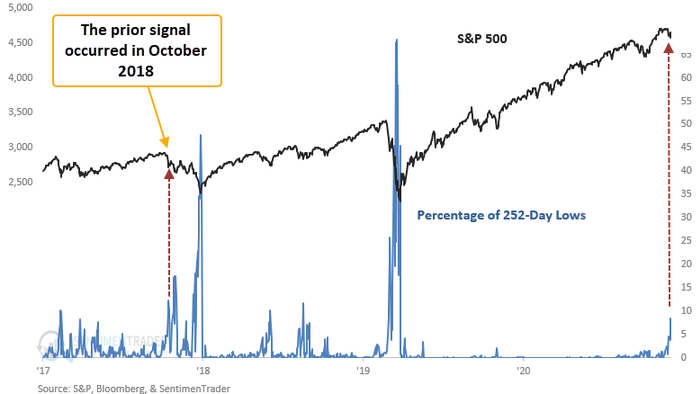

However, as Sentiment Trader pointed out this week, other internal measures suggest that investors may see lower returns near term. To wit:

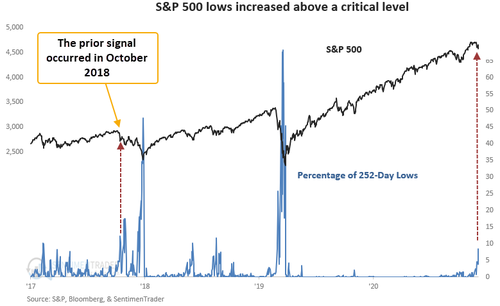

“New lows are one of the most critical breadth measures to monitor in a bull market, especially long-duration ones. When they expand to current levels with the market near a high, something is amiss with market participation. The shot across the bow is a warning that we should be alert to rising risks. As always, it’s essential to use a weight-of-the-evidence approach and not rely upon any single indicator.

The previous risk-off signal from October 2018 led to a substantial decline for the S&P 500.”

As they conclude:

“When new lows expand and the market is near a high, something is amiss with market participation, suggesting rising risks. Similar setups to what we’re seeing now have preceded weak returns and win rates on a short and medium-term basis.”

While the market is now very oversold, volume remains relatively weak along with money flows. Such suggests there is a risk of more selling pressure following any short-term bounce. So, as is always the case, be sure to manage your risk exposures accordingly.

There will be a time to become considerably more aggressive, but we need improvement to the underlying technicals first.

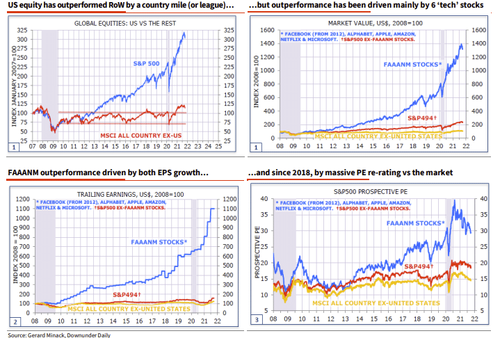

Will FANG Wind Up Like BRIC?

My colleague Albert Edwards had an excellent piece out this week answering a question I have had.

“It is the 20th anniversary of the invention of the BRIC acronym. BRICs, for those who need reminding, was dreamt up by the then Chief Economist at Goldman Sachs, Jim (now Lord) O’Neil, who predicted that the emerging economies of Brazil, Russia, India and China would enjoy superior economic growth and investment returns relative to the developed economies. A few days ago Jim O’Neil marked this anniversary with an update in theFinancial Times.”

Coincidently it is also exactly the 10th anniversary of my note that ridiculed ‘BRICs’ as an investment idea entitled ‘BRIC = Bloody Ridiculous Investment Concept’ – A. Edwards

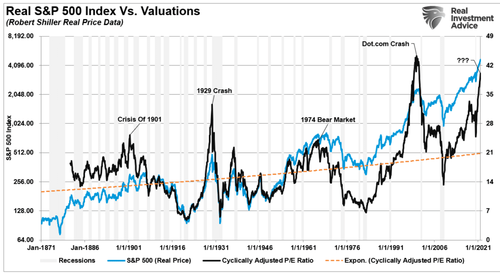

We should not overlook the importance of his commentary. In 1999, the “dot.com” bubble was in full swing, and valuations ran at nearly 42x trailing earnings on a CAPE ratio basis. Today, the top-10 stocks of the S&P 500 comprise almost 30% of the entire market capitalization of the index. With valuations once again approaching the dot.com levels of exuberance.

The Next Crash

As Michael Lebowitz noted in“Is A 2000 Market Crash Possible?”

“P/E valuations are grossly extended, and in both calculations nearing or surpassing levels in 1999. The graph also show valuations are well above those of 1929.”

The point here is that valuations matter. The growth expectations for the FANG stocks far exceed any conceivable realistic outcome. As Allbert concludes:

“Investors are desperate to believe the EM and BRIC growth story, for they have so little alternative. The story of superior growth for the EM universe is as entirely plausible as it is entirely misleading. Valuation is what matters for investing in EM, not their superior growth story and certainly, EM equities are not relatively cheap. Yet investors persist in the BRIC superior growth fantasy. But it is no different from many of the other investment fantasies I have witnessed over the last 25 years only to see them end in severe disappointment.” BRICs have indeed been terrible investments over the past decade, underperforming both MSCI World and even the EAFE index by a very wide margin.

Put a date in your diary to look out for my Global Strategy Weekly on 2 Dec 2031. For I have a similar feeling that in a decade’s time FAANGs (and US tech generally) will go the way of the BRICs as another example of acronym investing going horribly wrong. Indeed, only recently I noted that despite US IT’s EPS relative now declining sharply, its nosebleed PE valuation at 30x looks vulnerable vs the market’s 22x – the widest gap since the Nasdaq bubble.”

Valuations always matter, and they matter a lot. The problem is that investors don’t learn this lesson until it is often far too late to matter.

Please consider becoming a $10 a month donor. (Donate HERE)

Stillness in the Storm Editor: Why did we post this?

The news is important to all people because it is where we come to know new things about the world, which leads to the development of more life goals that lead to life wisdom. The news also serves as a social connection tool, as we tend to relate to those who know about and believe the things we do. With the power of an open truth-seeking mind in hand, the individual can grow wise and the collective can prosper.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammatical mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

https://www.zerohedge.com/markets/omicron-selloff-it-over-yet

Support our work! (Avoid Big Tech PayPal and Patreon)DIRECT DONATION

Leave a Reply