The MSM would have us believe we are on our way to a wonderful economic recovery, but if you actually look at the Data, nothing could be further from the truth. Indeed this is more Data confirming major changes coming for the world Economy.

THURSDAY, AUGUST 15, 2013

US Mortgage Lending is Tumbling

Yves here. We had predicted that the sharp rise in mortgage rates precipitated by the Fed’s taper talk would put a damper on the housing “recovery” and could even send it into reverse if rates continued to increase. They’ve in fact fallen over the past few weeks but are still markedly higher than in the spring. The central bank has been sending mixed signals over the last week or so, on the one hand seeming more inclined to taper based on its cheery view of the fundamentals, but concerned over what a budget slugfest might do to the confidence fairy.

MacroBusiness provides a good overview of the latest releases. It’s important to notice its comments on consumer deleveraging. That’s a decided negative for growth, particularly in combination with the ongoing effects of the sequester.

As Wolf Richter pointed out:

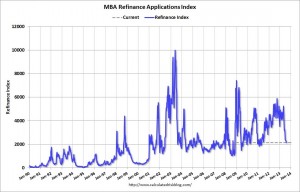

Mortgage applications have been on a brutal decline that started in early May. For the week ending August 9, the Mortgage Bankers Association’s Composite Index dropped 4.7%, with the Refinance Index down 4% and the Purchase Index down 5%. It isn’t a fluke. Mortgage applications have plunged 50% from early May and have hit a level not seen since April 2011.

Average interest rates for 30-year fixed-rate mortgages, at 4.56%, are nearly a full percentage point higher than in early May. These higher rates have been colliding with much higher home prices. Result: a dizzying jump in mortgage payments. Sticker shock for prospective buyers.

So first-time buyers now account for only 29% of total sales; prior to the housing crash, they accounted for up to half. The Fed’s “wealth effect” policies are pushing average Americans out of the housing market. Of course, they don’t have to be homeless. About half of the vacant single-family homes that these private equity firms and REITs have acquired are still vacant – maybe they’d cut some deals on rent.

By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Cross posted from MacroBusiness

Last night markets appeared to embrace more taper prospect. However the data was not favourable. It is now quite clear that the US mortgage market has turned sharply on the taper inspired spike in bond yields and hence mortgage rates. From the Mortgage Bankers Association:

Mortgage applications decreased 4.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 9, 2013. … The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. … The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.56 percent from 4.61 percent, with points decreasing to 0.39 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. … The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.60 percent from 3.66 percent, with points decreasing to 0.35 from 0.43 (including the origination fee) for 80 percent LTV loans.

As usual, Calculated Risk has the charts:

Remember that US house prices actually track the refinancing index quite closely so I expect price gains are likely to slow sharply in the not too distant future, slowing consumption as well, although the new construction wave will proceed. Nonetheless, the 30 year bond is sitting right at the top of its recent range with yields at 3.75%.

Also weighing against any imminent taper were producer prices, which were unchanged on the month and sit at 2.1% year on year.

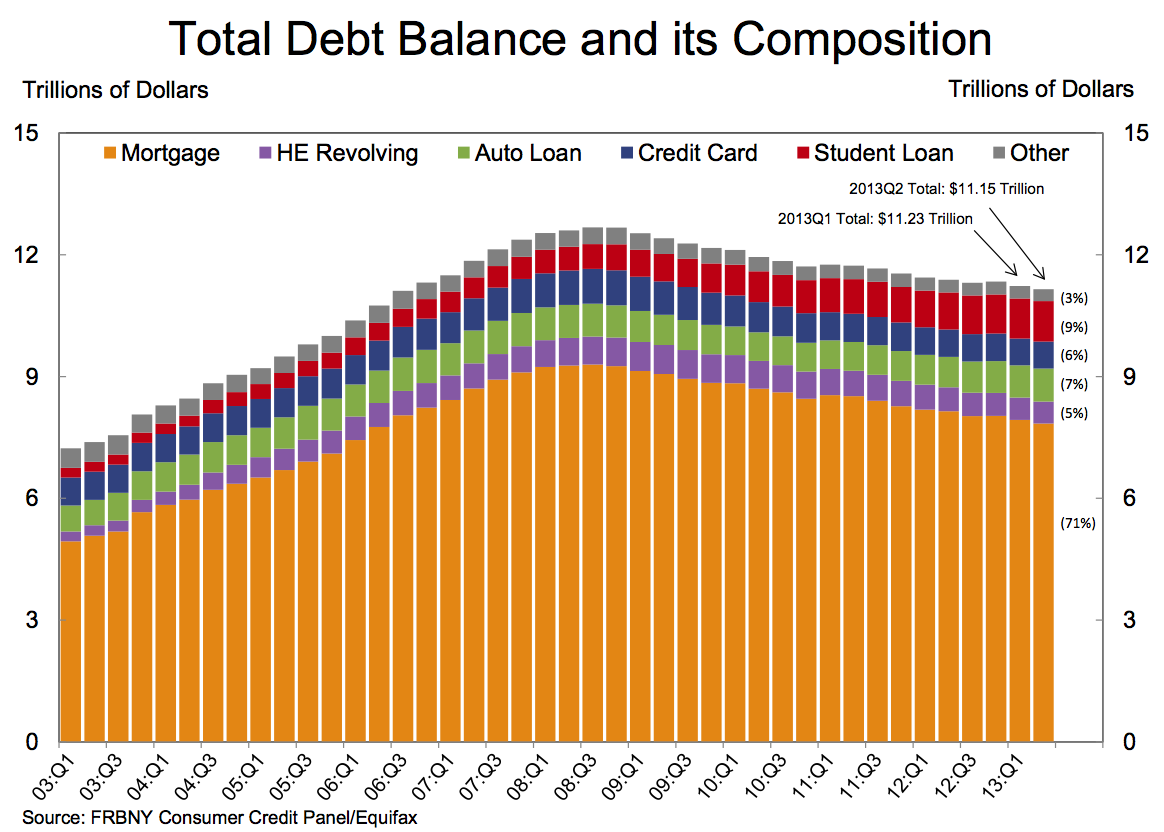

Rounding out our evening’s data, despite the recent surge in mortgage debt, US households continue to deleverage, according to the Fed:

The Fed told us it was going to taper to prevent excessive leverage building up as the cycle accelerated. It is succeeding but growth is not going to accelerate as a result.

Source:

Leave a Reply