(Michael Snyder) Global stocks are falling precipitously once again, and banking stocks are leading the way. If this reminds you of 2008, it should, because that is precisely what we witnessed back then.

Finance

Bigger than TRUMP: US LED World Order is COLLAPSING

Bigger than TRUMP: US LED World Order is COLLAPSING

101 Reasons Why The Federal Reserve Should Be Shut Down

(Michael Snyder) Donald Trump just made one of the most brilliant moves of his entire presidency. By accusing the Federal Reserve of “going loco”, he is placing the blame for the coming stock market crash and horrifying economic downturn squarely where it belongs, and he is firing up millions of true conservatives among his base at the same time.

Dollar Crash Imminent: China And Japan Dump U.S. Treasuries

(Mac Slavo) The two main holders of United States Treasuries, the countries of China and Japan, have dumped the dollar. Both nations have dramatically cut their ownership of notes and bonds in August, according to the latest figures from the US Treasury Department, released on Tuesday.

SWIFT and the Weaponization of the U.S. Dollar

(Michael Maharrey) The Trump administration dropped 44,000 bombs in its first year, a faster bombing pace than President Obama, who bombed more than President Bush. America has intervened militarily in other countries for decades against the council of founders like George Washington, who advised that America should “observe good faith and justice towards all nations; cultivate peace and harmony with all.”

We Witnessed The 3rd Largest Point Crash In Stock Market History On The Same Day That The 3rd Most Powerful Hurricane To Ever Hit The U.S. Made Landfall

(Michael Snyder) If you don’t believe in “coincidences”, what are we supposed to make of this? On Wednesday, the 3rd most powerful hurricane to ever hit the United States made landfall in the Florida panhandle. Entire communities were absolutely shredded as Hurricane Michael came ashore with sustained winds of 155 miles per hour.

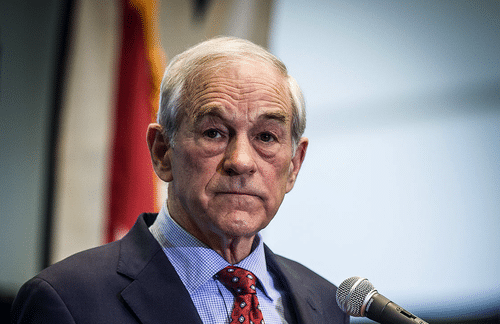

Ron Paul Warns A 50% Stock Market Decline Is Coming…And There’s No Way To Stop It

(Michael Snyder) Is Ron Paul about to be proven right once again? For a very long time, Ron Paul has been one of my political heroes. His willingness to stand up for true constitutional values and to keep saying “no” to the Washington establishment over and over again won the hearts of millions of American voters, and I wish that there had been enough of us to send him to the White House either in 2008 or in 2012.

EU, Russia, Iran, and China Unveil New Global Payment System Independent of US

(Zero Hedge) In a stunning vote of “no confidence” in the US monopoly over global payment infrastructure, one month ago Germany’s foreign minister Heiko Maas called for the creation of a new payments system independent of the US that would allow Brussels to be independent in its financial operations from Washington and as a means of rescuing the nuclear deal between Iran and the west.

Debt Rises: The Government Will Soon Spend More On Interest Than on The Military

(Mac Slavo) As debt and interest rates rise, the government is about to be in a disastrous situation. Very soon, they will spend more money paying interest on the national debt than they will on the bloated military budget.

New Vehicle Sales “Collapse” And Pending Home Sales “Plunge” As America’s Economic Slowdown Accelerates

(Michael Snyder) In late 2018, the bad economic news just keeps rolling in. At a time when consumer confidence is absolutely soaring, the underlying economic numbers are clearly telling us that enormous problems are right around the corner.

Do They Know Something We Don’t? Corporate Insiders Are Selling Stocks At The Fastest Pace In 10 Years

(Michael Synder) A lot of things are starting to happen that we haven’t seen since the last recession. A few days ago, I wrote about the fact that home sellers in the United States are cutting their prices at the fastest pace in at least eight years, and now we have learned that corporate insiders are selling stocks at the most rapid pace in ten years.

Why Are So Many People Talking About The Potential For A Stock Market Crash In October?

(Michael Snyder) It is that time of the year again. Every year, people start talking about a possible stock market crash in October, because everyone remembers the historic crashes that took place in October 1987 and October 2008. Could we witness a similar stock market crash in October 2018?

Evidence The Housing Bubble Is Bursting?: “Home Sellers Are Slashing Prices At The Highest Rate In At Least Eight Years”

(Michael Synder) The housing market indicated that a crisis was coming in 2008. Is the same thing happening once again in 2018? For several years, the housing market has been one of the bright spots for the U.S. economy. Home prices, especially in the hottest markets on the East and West Coasts, had been soaring. But now that has completely changed, and home sellers are cutting prices at a pace that we have not seen since the last recession. In case you are wondering, this is definitely a major red flag for the economy. According to CNBC, home sellers are “slashing prices at the highest rate in at least eight years”…

It Begins: Russia Officially Announces ‘Time Has Come…To Get Rid of the Dollar’

(Matt Agorist) In a retaliatory move to the growing list of sanctions placed on Russia by the U.S., the country has announced it will “get rid of the dollar.”

Mainstream DIsclosure? | Forbes — Has Our Government Spent $21 Trillion Of Our Money Without Telling Us?

(Laurence Kotlikoff) On July 26, 2016, the Office of the Inspector General (OIG) issued a report “Army General Fund Adjustments Not Adequately Documented or Supported”. The report indicates that for fiscal year 2015 the Army failed to provide adequate support for $6.5 trillion in journal voucher adjustments. According to the GAO’s Comptroller General, “Journal vouchers are summary-level accounting adjustments made when balances between systems cannot be reconciled. Often these journal vouchers are unsupported, meaning they lack supporting documentation to justify the adjustment or are not tied to specific accounting transactions…. For an auditor, journal vouchers are a red flag for transactions not being captured, reported, or summarized correctly.”