(The Guardian) A report published by the Brookings Institution analyzed data on the $1.3tn of US student loan debt and found that nearly 40% of borrowers could default on their student loans by 2023. Photograph: Seth Wenig/AP

Finance

Lord Jacob Rothschild Issues Warning: The New World Order is in Jeopardy

(Zero Hedge) Over the past three years, an unexpected voice of caution has emerged from one of the most legendary families in finance: Lord Jacob Rothschild.

Support this site so we can continue to tell you the truth.

DONATE HERE

Follow the Rothschild, Soros, and Rockefeller Money to Uncover the Deep State

(Alex Newman) With almost unlimited capital, Wall Street moneymen use it to centralize government. Their plans smack of worldwide crony capitalism, with government rules made to order.

Beware – The Last 7 Times The Yield Curve Inverted The U.S. Economy Was Hit By A Recession

(Michael Snyder) Seven times since the 1960s we have seen the yield curve invert, and in each of those seven instances an economic recession in the United States has followed. Will this time be any different? Today, the yield curve is the flattest that it has been in 11 years, and many analysts believe that we will see an inversion before the end of 2018.

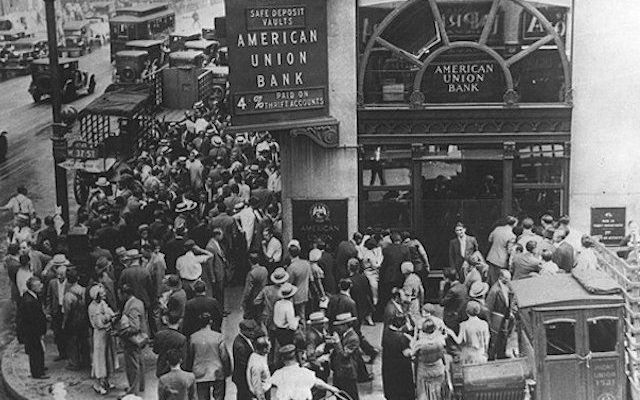

The Bankruptcy of America – 1933

(Judge Dale) Hint: A Lot More Happened than Just the Confiscation of the People’s Gold!

Why CONFIDENCE is the Backbone of the New Monetary System

QUESTION: Mr. Armstrong; I found your recent article on inflation and contagions fascinating. Am I correct in summing it up that today because currencies are not commodity based, they rise and fall on anticipation of political events whereas under precious metals contagions took place by one country debasing compared to another?

Establishment Stole $50 Trillion & Wants to Keep It (Video)

Establishment Stole $50 Trillion & Wants to Keep It (Video)

Rothschild Bank Ensnared in Money Laundering Scandal that Led to Arrest of Malaysian President

(Jay Syrmopoulos) The Rothschild Bank is the subject of an international investigation after it was accused of laundering billions of dollars.

Russia Dumps Massive Amount of U.S. Treasury Holdings—Becomes World’s Largest Holder of Gold

(Jay Syrmopoulos) Russia’s holdings of United States Treasury bonds is currently at its lowest point in 11 years as the country opts to invest in gold instead.

Please consider becoming a $10 a month donor.

(Donate HERE)

Trump Poised to Take Control of the Federal Reserve

(Richard X. Bove) President Donald Trump has multiple reasons as to why he should take control of the Federal Reserve. He will do so both because he can and because his broader policies argue that he should do so. The president is anti-overregulating American industry. The Fed is a leader in pushing stringent regulation on the nation. By raising interest rates and stopping the growth in the money supply it stands in the way of further growth in the American economy.

Rewriting History with Coins — Historians Refuse to Change Their Story… what else are they hidding?

(Martin Armstrong) QUESTION: Dear Martin,

I have been researching facts about history and there is strong evidence that what we were taught in school doesn’t fit with the reality.

Trump Sets His Sights on the Fed’s Tightening and the Strong Dollar — “It Was Only A Matter of Time”

(Palisade Research) Who says that the President doesn’t – and shouldn’t – pay attention to the U.S. Dollar’s value?

Ron Paul Warns That When The “Biggest Bubble In The History Of Mankind” Bursts It Could “Cut The Stock Market In Half”

(Michael Snyder) When this bubble finally bursts, will we witness the biggest stock market crash in U.S. history? “The bigger they come, the harder they fall” is a well used phrase, but I think that it is very appropriate in this case. From a low of 6,443.27 on March 6th, 2009, we have seen the Dow nearly quadruple in value since the last financial crisis.

Experts Warn Of Chaos For The U.S. Economy As China Declares That “The Biggest Trade War In Economic History” Has Begun

(Michael Snyder) Nothing is going to be the same after this. On Friday, the United States hit China with 34 billion dollars in tariffs, and China immediately responded with similar tariffs. If it stopped there, this trade war between the United States and China would not be catastrophic for the global economy.

European Powers Prepare to Ditch Dollar in Trade With Iran

(Elliott Gabriel) While the White House’s frenzied anti-Iran campaign has entailed unprecedented attempts to twist the arms of the United States’ traditional European allies, the pressure may be backfiring – a reality made all the more clear by Russian Foreign Minister Sergei Lavrov’s claims that Europe’s three major powers plan to continue trade ties with Iran without the use of the U.S. dollar.