See previous updates here.

– Justin

Globalist Agenda Watch 2015: Updates 76-77 – A new black swan joins the flock: a strategic default of Russia’s debt

(Update 76 -19 October 2015)

THE GLOBALISTS MISS THE “7″ TRAIN TO ECONOMIC CRISIS

Most of the time, the globalist agenda plods along at a pace so slow that the few in the public register its movement. But at certain times, they take a big leap towards their goals, such as…

> On September 11, 2001, when the Twin Towers fell, the world was plunged into perpetual war, and totalitarian amendments began creeping into the Western societies…

…and 7 years later…

> On September 15, 2008, when Lehman Brothers fell and took the global financial system with it, thus leading to a massive, ongoing consolidation of wealth into the banksters’ hands…

…and 7 years later…

So what happened? Why did the globalists miss their 7-year window last month and mess up their Magic 7 crisis numerology? Let’s take a moment to think it through…

They had set the stage for the September 2015 crisis very well:

1) Expectations for a September rate hike from the Federal Reserve had been established over the course of the year, and the IMF, World Bank, and BIS had issued their warnings to give themselves “we warned the Fed not to do it” bragging rights.

2) The US federal budget process was allowed to drift aimlessly through the year to set up another dramatic shutdown opportunity on October 1st.

3) The US government debt limit was ignored since March 15 to allow it to be brought up as a dire issue in the Fall.

With a pre-arranged set of crisis points in hand, the globalists were to use them as follows:

1) They planned to hike the Fed interest rate on September 17 to trigger an external crisis in the developing markets.

2) They planned to then trigger a US government shutdown on October 1st after the Pope’s visit to – and judgement of – the US. This would have brought the crisis home and led to a shutdown of record-setting duration.

3) They planned for the shutdown to segue into the debt limit battle in early November, and the US was intended to hit the limit and default, thus triggering a crisis of confidence in the US dollar and a full-on sh*tstorm in the global financial system. This would have set the stage for increasing military conflict as we march towards next September.

So why did they back off? Was it due to unfinished preparations, such as the non-adoption of bank bail-in rules in some EU nations? Was it due to excessive awareness of their plans in the blogosphere? And what is the significance of their inability to fulfill their Magic 7 numerological voodoo? Christine Lagarde must be heartbroken. Oh well, perhaps she can take solace in knowing that I think she’s a helluva gilf.

Although the globalists appear to have pressed the delay button, they certainly haven’t pressed the cancel button. They have a chance to trigger the same three events starting at the end of this month, and that will be the subject of an upcoming update.

(Update 77 – 20 October 2015)

A NEW BLACK SWAN JOINS THE FLOCK: A STRATEGIC DEFAULT OF RUSSIA’S DEBT

I came across a rather provocative propaganda piece on RT this morning: Moscow doubles down on Washington. It begins with this…

“History may eventually decide the ‘New World Order’ started on September 28, when Russian President Vladimir Putin and US President Barack Obama had a 90-minute face off at the UN in New York.”

September 28 was the day of the Super Blood Moon if you recall, and Putin met Obama after the eclipse had transpired. Given the deeply superstitious nature of the globalist “elite,” the article’s author, Brazilian Pepe Escobar, is probably right in saying the 28th will be the day history records the tide as turning against the West.

Escobar continues…

“Putin did press Obama for the US to join Russia in a real grand coalition bent on smashing ISIS/ISIL/Daesh. The Obama administration, once again, relented.”

Of course Obama didn’t join the “grand coalition”; the globalist script didn’t call for that. I wrote about the hidden purpose of ISIS back in September of 2014 (link)…

BEGIN EXCERPT >>> In my last update, I wrote this about the globalist strategy for the September – November time frame: “Bad Western conduct will also be clearly noted in the press. This combination of economic weakness and bad behavior will be seized upon by the BRICS nations as they press for the dissolution of Western dominance of the IMF and related institutions.” Well, the whole ISIS debacle is a glaring example of this; it is purposely transparent foolishness that sets up the BRICS alliance for an easy propaganda win.

And the BRICS knock it out of the park!…

It’s really a very simple strategy on the globalists’ part: have the Western division (which controls the old financial system) create transparent havoc, then have the Eastern division (which will bring in the new financial system) point out the West’s misconduct and earn trust from the public. The people will then see the BRICS as straight talking guys who are different from the evildoers in NATO. Of course, all one needs to do to see through this propaganda campaign is look at how the 99% are treated in the BRICS countries. Despite the stage plays the G20 politicians put on for public consumption, all the G20 central bankers are working from the same script. <<< END EXCERPT

And now we get to the good part of the RT article…

“So what Glazyev proposes, essentially, is that Moscow must gain total control of its Central Bank, preventing speculators to move their credit around for non-productive purposes…

Essentially, once again, a Russian default on a $1 trillion-plus debt to private Western parties remains a possible scenario discussed at the highest level – assuming Washington will persist in its anti-Russia demonization campaign.

It’s clear the squeeze Russia is feeling has less to do with sanctions than the grip maintained by Western financial powers over the Russian Central Bank. The Russian Central Bank did create a debt trap by maintaining high interest rates in Russia while the West was lending at low interest rates.

Needless to add, such a default, if it ever happened, would collapse the entire Western financial system.”

In this passage, we see a very clear application of the East versus West propaganda template. And the solution it offers is exactly what I wrote about in the NWO Schedule of Implementation page…

BEGIN EXCERPT >>> A core component of the globalists’ strategy to centralize power over the world’s currencies lies in making the Fed and their other national central banks look bad. For this reason, they’ve been deliberately staging “currency wars” and having their supranational institutions (the IMF and the BIS) and media propagandists point out the destructive nature of the policies being pursued at the national level. “Only at the international level,” they argue, “can currency stability be achieved.”

In keeping with this strategy, they are using their national central banks to blow up the global economy so their supranational institutions can step forward and restore order. And as they transition power from the national to the supranational level, they will close down the Fed and other central banks in order to transfer control of national currencies to their respective treasury departments. Since the central banksters have consolidated power over the national governments, they can safely move their “flag” from the central banks to the treasuries. The treasuries are run by their people anyhow.

So when you hear alternative media propaganda about “ending the Fed” and “bringing back a US Treasury dollar,” know that this is the solution the banksters want you to embrace. It is a solution designed to make it appear that the problem posed by the “evil Western central bankers” has been licked, but it’s just a scam. And in the US, Ron and Rand Paul are the primary controlled-opposition agents the globalists have designated to con you. <<< END EXCERPT

So this RT article hits all the points we’ve been expecting, but it adds something new to the mix: the specter of a strategic Russian debt default. Such a move would provide the pretext for collapsing the old financial system without the need for a Fed rate hike, a US government shutdown, and/or a debt ceiling-triggered US debt default. Nonetheless, these three events remain highly desirable for advancing the globalist agenda, and I’ll outline the reasons why in the next update.

For the previous updates in this series, click here.

With love…

Globalist Agenda Watch 2015: Updates 78-79 – The one-two punch that will knock down the dollar & Will the big shock be in two weeks or in March? (+ a P.S.)

(Update 78 – 20 October 2015)

THE ONE-TWO PUNCH THAT WILL KNOCK DOWN THE DOLLAR: A US DEBT CEILING HIT AND GOLD-BACKED BRICS CURRENCIES

…in order for the globalists to achieve this…

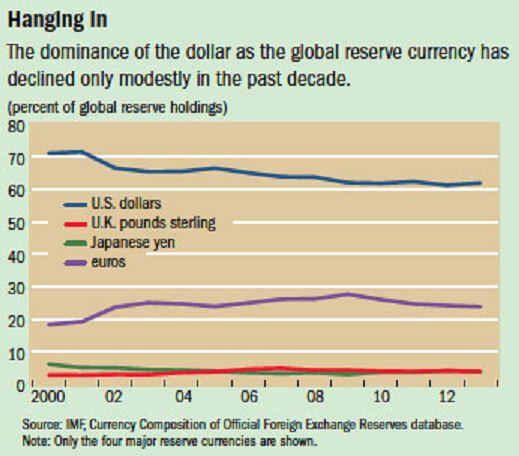

Despite all the stories you’ve read about Russian and Chinese currency and trade deals that bypass the dollar, the dollar has barely budged from its dominant position. As The Heritage Foundation puts it…

“The U.S. dollar has dominated the international monetary system for approximately 70 years. While the U.S. economy has generated weak growth over the past six years and accumulated a large sovereign debt, the dollar’s status as an international medium of exchange and reserve currency (currency held by foreign central banks) has defied the odds and has not diminished.”

Given the dollar’s resilience and the globalists’ self-imposed goal of having a de facto world currency in use around 2018, how can they go from 2015’s dollar-dominated financial system to a SDR-based financial system in just 3 short years? Clearly a big, jolting change would be necessary, and it would have to include two key components:

1) Something would have to happen to cause a dramatic loss of confidence in the dollar, and

2) Something would have to happen to cause a dramatic increase of confidence in other currencies and the SDR.

Looking at the first component… nuking confidence in the dollar, we must remember that the dollar lost its gold backing back in 1971, so the only pillar on which its perceived value is based is the “full faith and credit of the US government.” In other words, the only thing that gives the dollar value is the US government’s willingness and ability to pay their bills.

So what happens to the perceived value of the dollar if confidence is lost in the US government’s willingness and ability to pay its bills?

The perceived value would plummet, of course, and that is why the globalists have arranged opportunities for both a US government shutdown and a US debt default in the current timeframe. We could be facing the debt default in as little as 14 days, although I suspect they might delay it until the Spring.

Looking at the second component… building confidence in other currencies and the SDR, we see why the BRICS nations, particularly China and Russia, have been beefing up their gold reserves in recent years. When they announce a partial gold backing/valuation of their currencies, the BRICS will create “safe” currency havens to which freaked-out dollar holders can run. Since the IMF also has substantial gold holdings, we can expect them to join the BRICS by backing the SDR with gold as well. I wrote about this in The coming BRICS gold standard, Ron Paul, and the Rockefellers.

We could see the BRICS’ first hint of the gold-backing scheme in about a week, when Chinadebuts its next Five-Year Plan…

…A mere mention in that Plan of moving towards a gold-backed yuan would start the confidence ball rolling, but I suspect the actual backing won’t be implemented until the Spring at the earliest, around the time of the IMF/World Bank Spring Meetings.

(Update 79 – 21 October 2015)

WILL THE BIG SHOCK BE IN TWO WEEKS OR IN MARCH?

As we look forward from today, a potential sh*tstorm lies directly off our bow. Here is the sequence of events we face…

1) October 26-29: China will be holding their Central Committee Plenary Session where they will announce their new five-year plan. Should this plan speak of their intention to move to a gold backed/valued yuan, people all over the world will begin mentally weighing a coming golden yuan against a fiat dollar, and a major shift in monetary paradigms will ensue.

2) October 27-28: The FOMC will meet, and there are arguments to be made that a surprise rate hike might be in store. None of the arguments have to do with economic data or the altruistic-sounding supposed mission of the Fed; they have to do solely with the globalist agenda.

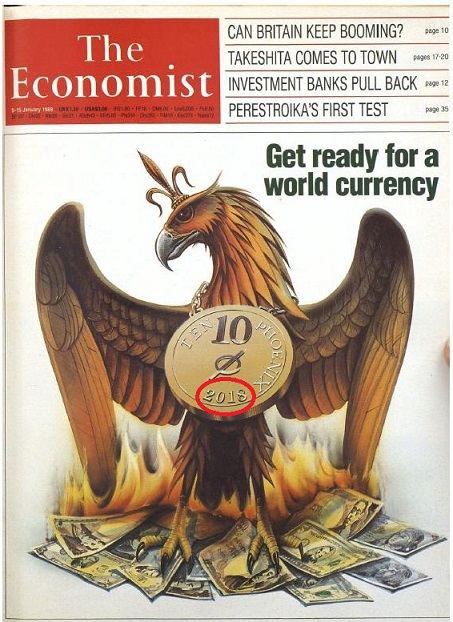

The globalists would be well-served by the US central bank raising rates and pissing off the entire world by making their dollar-denominated debts harder to service and roll over. Such a move would cause a stampede towards the BRICS and a bitter determination to get out from under dollar domination. On top of this, an October hike would be the banksters’ only opportunity to fulfill what they hinted at in the infamous Economist cover earlier this year…

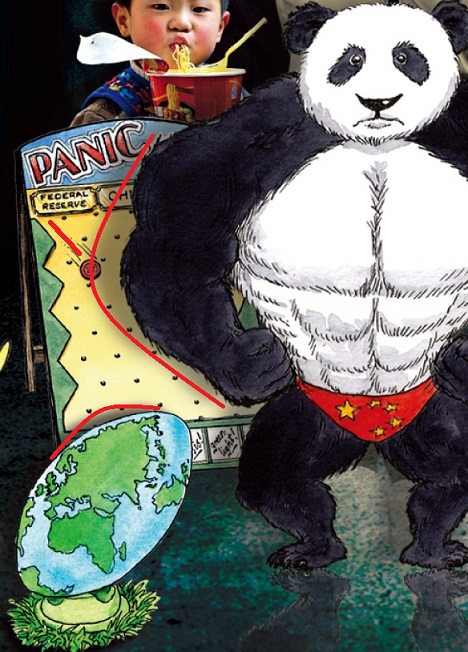

…which suggests the Fed will set a panic in motion under the shadow of the Rugby World Cup (bottom left)…

…The Cup ends with its final match on October 31. Also note that a strong-looking China casts a shadow over the panic board. And what could make China look strong at the same time the Fed sets a panic in motion? The Central Committee announcing a move towards a golden yuan during its meeting that overlaps the FOMC meeting. Could the hints be any more clear?

3) November 3: The US government is scheduled to hit its debt limit on that day, and this would set something very impactful in motion…

A debt ceiling hit could not only lead to a US government debt default (thereby undermining the “full faith and credit of the US government”), but it could also lead to an immediate and near-total shutdown of the US government.

Let’s have a look at what Jack Lew said in this CNBC article…

…from two days ago…

>>> Treasury Secretary Jack Lew said Monday he worries that waiting until the last minute to raise the nation’s borrowing authority could result in an accident “that would be terrible.”

Last week, Lew said the U.S. debt ceiling will be exhausted Nov. 3, two days before previously estimated. In a letter to congressional leaders, he added that a remaining cash balance of less than $30 billion would swiftly deplete…

Lew dismissed the idea that the government could prioritize what bills to pay. “Once you no longer consider all of your obligations rock solid, you’re no longer the full faith and credit of the United States.”

“It’s also not possible to pick and choose. We have about 80 million transactions a month. Our system wasn’t set up not to pay,” he added. <<<

What he’s hinting at here is that he’d have to shut down the whole US government payment system, which means no bills at all will be paid. The whole government would grind to a halt (except for those who would go to work with no pay). Such an outcome would make America look like a dysfunctional banana republic, and who would trust in the “full faith and credit” of such a nation?

That being said, John Boehner is still the Speaker of the House, so I would expect him to join with Democrats to pass some sort of debt limit measure. And it could be the same sort of thing we saw the last time all this happened in 2013. From Wikipedia’s entry on the United States debt-ceiling crisis of 2013…

>>> In mid-January, Paul Ryan, Chairman of the House Budget Committee, floated the idea of a short-term debt ceiling increase. He argued that giving Treasury enough borrowing power to postpone default until mid-March would allow Republicans to gain an advantage over Obama and Democrats in debt ceiling negotiations. This advantage would be due to the fact that postponing default until mid-March would allow for a triple deadline to be in March: the sequester on March 1, the default in the middle of the month, and the expiration of the current continuing resolution and the resulting federal government shutdown on March 27. This was supposed to provide extra pressure on the Senate and the President to work out a deal with the Republican-led House. <<<

So Paul Ryan, who is currently being mentioned as Boehner’s replacement, favored pushing back the debt ceiling till March back then. Given that fact, we could very well see something along those lines passing the Congress in the next two weeks. Boehner could suspend the debt ceiling until March under the pretext of…

> Appeasing the House conservatives by not pushing through a long term increase of the ceiling, and

> Giving his replacement time to get settled and work towards a consensus before a long term decision is made.

Should they move towards such a bill, I’d expect them to throw in another continuing resolution to keep the government funded till then. That way, they could “settle all of it at once without the pressure of an imminent deadline.”

Once March comes, I’d expect things to break down “due to political posturing in advance of the Presidential and Congressional elections,” which would result in a shutdown and default. And this would help set the stage for contentious IMF/World Bank Spring Meetings with a world already enraged by the effects of a Fed rate hike. America would hold its ground and block reform at the meeting, and this would provide pretext for increasing military conflict.

A lovely scenario, no? Let’s see if they’ll follow through.

(P.S. – 21 October 2015) – Whilst pondering the Economist cover, I realized something I’d previously overlooked. Have a second look at that section to see what it is.

For the previous updates from this series, click here.

Love always…

_________

Sources:

Leave a Reply