(Zero Hedge) According to a new report from Truth in Accounting, the most-indebted states include New Jersey, Illinois, Connecticut, Massachusetts, Hawaii, Delaware, Kentucky, California, and New York.

Related 18 Facts on the US National Debt That Are Almost Too Hard to Believe

by Staff Writer, September 28th, 2019

Truth in Accounting published the Financial State of the States report, a regional analysis of the most recent state government financial data, on Tuesday, that is one of the most comprehensive studies of the economic conditions of all 50 states. The report includes the most up-to-date state finance and pension data, trends across the states, and key findings.

The report said all 50 states have had to become more transparent in their financial reporting over the last several years, thanks to the implementation of Generally Accepted Accounting Principles set by the Governmental Accounting Standards Board.

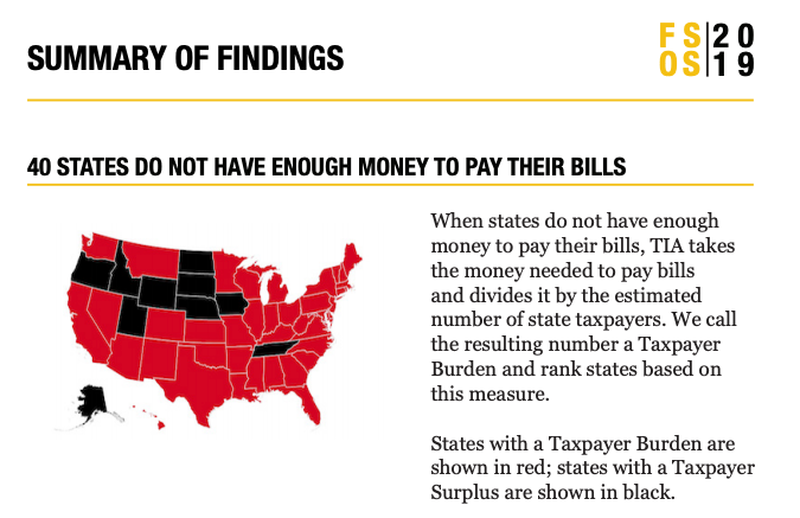

Researchers this year uncovered something truly shocking: “40 states do not have enough money to pay all of their bills and in total the states have racked up $1.5 trillion in unfunded state debt.”

Buy Book Conspirator’s Hierarchy : The Committee of 300

Truth in Accounting ranks the states below according to their Taxpayer Burden or Surplus, which at the end of the day, it’s what the taxpayer is on the hook for.

Here are the rankings (from less indebted to most indebted):

- Alaska, $74,200 per taxpayer

- North Dakota, $30,700

- Wyoming, $20,800

- Utah, $5,300

- Idaho, $2,900

- Tennessee, $2,800

- South Dakota, $2,800

- Nebraska, $2,000

- Oregon, $1,600

- Iowa, $700

- Minnesota, -$200

- Virginia, -$1,200

- Oklahoma, -$1,200

- North Carolina, -$1,300

- Indiana, -$1,700

- Florida, -$1,800

- Montana, -$2,100

- Arkansas, -$2,300

- Arizona, -$2,500

- Nevada, -$3,100

- Wisconsin, -$3,200

- Georgia, -$3,500

- Missouri, -$4,300

- New Hampshire, -$5,000

- Ohio, -$6,600

- Kansas, -$7,000

- Colorado, -$7,200

- Washington, -$7,400

- Maine, -$7,400

- West Virginia, -$8,300

- Mississippi, -$10,000

- Alabama, -$12,000

- Texas, -$12,100

- New Mexico, -$13,300

- Rhode Island, -$13,900

- South Carolina, -$14,500

- Maryland, -$15,500

- Michigan, -$17,000

- Pennsylvania, -$17,100

- Louisiana, -$17,700

- Vermont, -$19,000

- New York, -$20,500

- California, -$21,800

- Kentucky, -$25,700

- Delaware, -$27,100

- Hawaii, -$31,200

- Massachusetts, -$31,200

- Connecticut, -$51,800

- Illinois, -$52,600

- New Jersey, -$65,100

Stillness in the Storm Editor: Why did we post this?

The preceding information is a news update. In general, staying informed as to events taking place is essential as an individual because it helps you navigate the world, and socially because you can gain and maintain rapport with your fellows. This rapport can be used to share information that can help others and improve the conditions of humanity in general. However, one must learn how to exercise discernment and proper critical thinking so they can make effective use of information gained.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammar mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

https://www.zerohedge.com/personal-finance/debt-bombs-here-are-states-most-debt

Leave a Reply