| Image Source. |

Dow closes down 600 after Brexit surprise; financials post worst day since 2011

by Evelyn Cheng

Brexistential Bloodbath – Dow Crashes 600 Points As Vol Explodes

by Tyler Durden

Overheard in Britain today…

Well they did it… and no one expected it…

- UK Stocks -3.14% worst since Jan 2016

- US Stocks -3% worst since Aug 2015 (biggest opening gap down since 1987)

- VIX +6pts biggest daly rise since Aug 2015 crash

- Japan Stocks -7.9% worst since 2011 (Tsunami)

- Spain Stocks -12.5% worst since 1987

- Italy Stocks -12% worst since 1997

- EU Banks -14.5% worst ever

- US Banks -4.75% worst since Nov 2011

- US 30Y Yield -14bps biggest drop since 2011

- US 2Y Yield -14bps biggest drop since 2009

- German 10Y Yield -14bps biggest drop since 2011

- GBPUSD -11% biggest drop ever

- USDJPY -4% biggest drop since 1998

- EURUSD -2% biggest drop since Oct 2015

- Gold +5% biggest day since Lehman 2008

- Crude -4.4% most since Jan 2016

But apart from that everything is awesome.

What it looked like when Brexit news hit gold and currencies (h/t @NanexLLC)

The broad EU banking system bore the brunt of it…

and peripheral Europe was a bloodbath…

As Cable saw its biggest intraday swing ever…

Across asset classes, here is how the day went…

On the day, the early dead cat bounce died…

- *DOW AVERAGE PLUNGES 610 POINTS AT 4 P.M., MOST SINCE AUGUST

- *NASDAQ COMPOSITE TUMBLES 4.1% IN BIGGEST ROUT SINCE 2011

Dow dropped 850 from pre-Brexit highs…

Today’s S&P drop was just shy of the collapse on Aug 24th last year…

Financials were a yuuge loser, catching down to the yield curve… worse drop that Aug crash and broke all major technical support…

Since the Jo Cox death lows, stocks are now red…

All major US equity indices are now red year-to-date…

Since The Fed raised rates, Gold is up 23%, Bonds up 12%, and Dow down 1.7%…

VIX exploded (but we note that XIV – inverse VIX ETF – dropped almost 30%, the biggest move ever and 7 standard deviation shift)

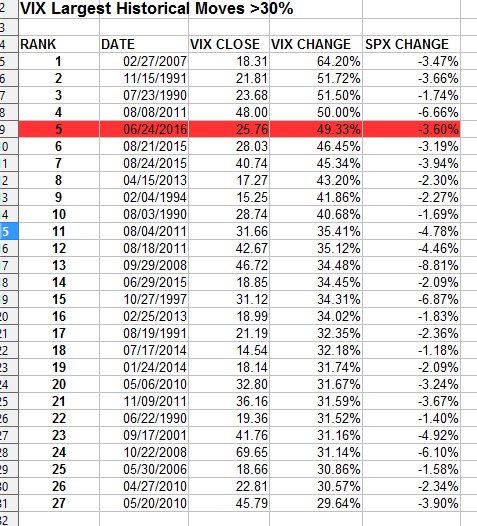

It was one of the Top 5 moves in VIX ever:

And the Final Print as of 4:15pm puts today as the 5th largest move in history.

With S&P losing 2,100 as VIX topped 24…

On the day, VIX surged after the cash close, dragging futures even lower…

So next we turn to FX markets…

Cable fell to 31year lows… Today’s drop was a 16 standard deviation crash

The USDollar Index rose 1.3% on the week (best in 4 months), driven by major spike today, but the GBP and JPY moves were colossal…

And on the day – GBP and JPY were the big movers…

Treasury yields dropped drastically today, puking before the US open but bounced higher to leave 30Y yields unch on the week…

Commodities flipped overnight with crude ending the week the biggest loser and PMs best…

On the day, gold unusually outperformed silver…

Gold and Silver soared…

AND JUST REMEMBER – CHINA WAS CLOSED BEFORE THIS BLOODBATH STARTED…

Charts: Bloomberg

Bonus Clip: Risk just went to 11…

_________________________

Stillness in the Storm Editor’s note: Did you find a spelling error or grammar mistake? Do you think this article needs a correction or update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

The headline of this article is a merger of the two articles contained within it. Original headlines posted above articles respectively.

_________

Sources:

http://www.cnbc.com/2016/06/24/us-markets.html

http://www.zerohedge.com/news/2016-06-24/brexistential-bloodbath

Stalingrad & Poorski @Stalingrad_Poor

Stalingrad & Poorski @Stalingrad_Poor

Leave a Reply