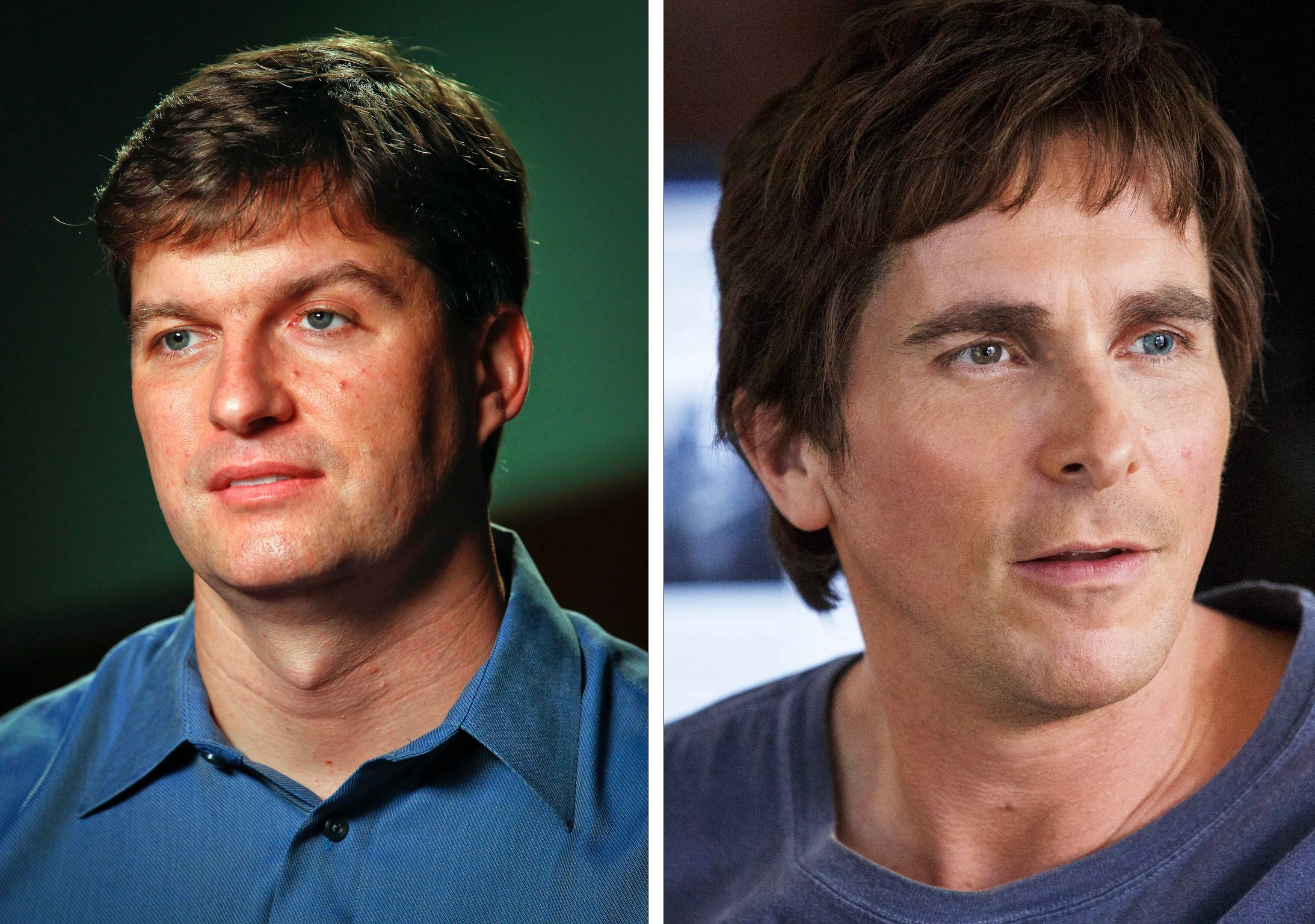

(Joe Martino) You might remember the famed hedge fund manager Michael Burry from the film ‘Big Short,’ his character was played by Christian Bale. He is best known for forecasting the 2008 financial crisis, and he made billions from that bet. In a recent tweet, Burry has suggested that governments could “squash” Bitcoin (BTC) in a coming inflationary crisis due to further pandemic stimulus.

Related Bitcoin Uses More Energy Than All of Argentina

by Joe Martino, February 24th, 2021

Burry also feels that further regulation of the decentralized currency could hamper BTC’s performance in the long term. With one of the main motivations behind cryptocurrency’s like BTC being that they are intended to operate outside of government control and regulation, you can bet that the millions who invest in crypto intend that it stays that way – out of the governments reach.

In a now deleted series of Tweets, Michael Burry stated some intriguing opinions about Bitcoin and potential government interventions:

I don’t hate BTC. However, in my view, the long term future is tenuous for decentralized crypto in a world of legally violent, heartless centralized governments with lifeblood interests in monopolies on currencies. In the short run anything is possible – why I am not short BTC.

Burry claiming he is not ‘short’ on BTC means he is not betting that its price will fall significantly anytime soon.

One of the major reasons Burry feels governments could squash BTC is due to coming inflation as a result of more pandemic stimulus. “In an inflationary crisis, governments will move to squash competitors in the currency arena. $BTC #gold,” he said. As you can sense by Burry’s words, he feels governments will do anything in their power to maintain control over their own currencies, and protect them at all costs, regardless whether it’s what benefits people most or not.

In his recent string of tweets he discussed Germany’s path to hyperinflation in the 1920s. He currently sees America’s economic trajectory to be similar to the post-World War I climate that eventually led to a 320% monthly inflation rate in the country.

If Burry is right about the upcoming inflation and the governments potential regulatory actions on BTC, this will be the 2nd time in recent years that he predicted a seismic shift in the US economy.

Modern Structures Are Failing

This inevitably brings up the discussion of our current way of life when thinking about our societal design. Does a capitalistic economy really create a world where people can thrive? Does it inspire big business and governments to think about people’s well being first? Or does it motivate them to think of profits first? Perhaps it’s our underlying worldview of competition and separation that causes us to create society in this manner? Either way, history over the last 30 years has shown us that financial crisis’ are happening at a faster rate, each time pushing more and more people into a lower socio-economic class while the few become richer. Aside from available spending money, think of how this affects people’s basic ability to survive and enjoy life.

COVID-19 served to make billionaires even bigger billionaires, while the average person struggles to get a job, feed their family and make basic payments. Is this a world we want to live in? Does this truly feel like what we’re capable of or are we being convinced to accept something because someone said so?

Are we really to support the idea that governments should regulate cryptocurrency, a means of exchange that is outside their control? What’s the motivation behind their regulation? As faith in our institutions crumbles year after year, is the culture within governance feeling their increasing loss of power over the people?

I don’t intend to write a lengthy piece deeply exploring the ins and outs of our economic model and why it’s not serving the people, I’ll save that for another time. I sense that the questions I’ve posed will already bring up thoughts and feelings within you that tend to ‘know’ our current ways aren’t working to help people thrive, perhaps that’s enough.

Where I’m curious to push the envelope a little further is in the question of why do we believe that we need currency and exchange to begin with? Why must our economies work the way we do? Have we really chosen to ask this question? Or have we accepted the limited and dishonest historical belief that “we tried everything else and this is best?”

A radical idea to consider I know, but one I invite you to imagine for just a moment. Given all the the incredible technology we have available to us today, can we really not imagine a society where money is not required? Given the emerging information in post material science that is telling us a different story about the nature of humans, can we honestly say we are simply competitive and warring animals still?

For just a moment, set aside the judgements someone might cast upon you for considering that we could live in a world without money, things like “that’s socialism!” or “That’s communism!” If you were tasked with the project of coming up with a way to live in our world without money, how might it look? How would we go about creating that type of community?

Aside from what we’re commonly told, human beings are incredible, with extraordinary abilities to connect, build community and solve problems. If we changed the conversation from “that’s never going to be possible” to “how might we actually go about doing this?” that innocent little shift allows us to be open, sense possibility and activate our creativity, even if it means we aren’t going to take action right away.

I’ve been doing this sort of work and asking these questions my whole life – professionally for 13 years – I don’t hold the naive position that all of this can just happen on its own or that we don’t require deep questioning of our current worldview, I recognize all of this is necessary. What I am saying though is, if we don’t begin to think and explore down this path, we can’t ever make things ‘better.’

So what are you choosing to do? Accept the world as it is today? Or are you open to imagining a world where people can truly thrive?

About The Author

It’s funny, I have a tough time calling myself a ‘journalist,’ perhaps it’s just one of the hats I wear. Deep down I get a lot out of connecting our individual and collective narratives to world events. Why do we create the world the way it is? What does that tell us about how we can change our world? I founded CE 11 years ago as I love inspiring to make lasting shifts in their individual consciousness, which sets conditions for deep meaningful change in our world.

Stillness in the Storm Editor: Why did we post this?

The news is important to all people because it is where we come to know new things about the world, which leads to the development of more life goals that lead to life wisdom. The news also serves as a social connection tool, as we tend to relate to those who know about and believe the things we do. With the power of an open truth-seeking mind in hand, the individual can grow wise and the collective can prosper.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammatical mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

Leave a Reply