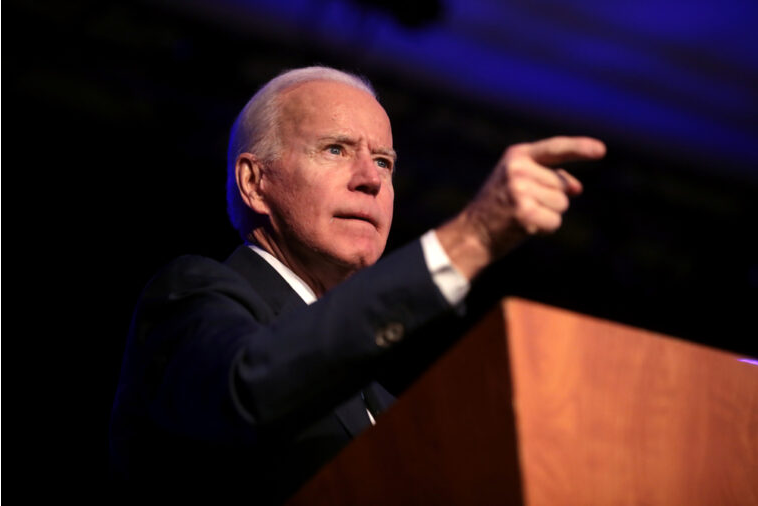

(Jonathan Davis) Late last week after Fraudulent US President Joe Biden signed the $1.9 trillion Democratic constituency payoff bill disguised as “COVID relief,” most Americans started getting $1,400 payments from Uncle Sam.

Related Biden, Pelosi Don’t Join Chorus Seeking Cuomo’s Resignation, Urge Letting Investigation Finish

by Jonathan Davis, March 16th, 2021

That doesn’t seem like much money given the fact that tens of millions of Americans suffered lengthy financial hardship over the past year governors shut down their states and as Democrat governors continued to keep their states essentially locked down for months afterward.

But even that paltry amount of money will seem even less if Democrats pass Biden’s new tax legislation, which contains the largest increase since 1993.

The Daily Caller reports:

“The Fraudulent Biden administration is allegedly contemplating a series of tax hikes on high income earners and corporations that could potentially yield more than $2 trillion in revenue over the next decade.

Bloomberg News first reported Monday morning that President Joe Biden will likely outline the plan during his joint session address to Congress, expected to take place before the end of the month. The not-yet-finalized proposal would mark the first significant tax increases since former President Bill Clinton’s 1993 tax bill.

Four people familiar with the discussions told Bloomberg that the president’s proposal, while outright rejecting Sen. Elizabeth Warren’s wealth tax, would raise both the income tax rate for filers making more than $400,000 per year and the corporate gains tax for filers earning more than $1 million per year. Furthermore, Biden is expected to pursue a 7 percent increase in the corporate tax rate and limit ways for sole proprietorships and other “pass-through” businesses to avoid paying corporate taxes.”

“So what?” ordinary Americans may be thinking. “I don’t make that kind of money and I sure don’t own a large corporation.”

Here’s the ‘so what’ — this tax scheme will raise the cost of just about everything under the sun, from the products we buy to the gas we burn to the electricity we use to heat and cool our homes and the food we buy to eat.

Aside from taxes being a necessary evil (to an extent), taxes raise costs of doing business while taking money out of the economy that would otherwise be spent in it.

If corporations are taxed more, they will pass those costs back onto consumers. That’s just an automatic; that is the equal and opposite reaction from a company or corporation every time their profit margins are hit (and taxes strike at the heart of profit margins).

“Do the rich actually pay for the higher taxes when they become law? Technically, the answer is yes. But the reality is that those costs are usually just passed on to other people or spending is restricted,” Marcus Hawkins writes at ThoughtCo.

“Either way, the net effect is often a huge hit on the economy. Millions of small and medium-sized businesses fall into the target zone for higher taxation. If a small business is hit with higher costs due to an increase in fuel prices or raw goods, those increases are usually just passed on to the consumers, and those with less disposable income see their costs rise to sometimes devastating levels,” Hawkins notes further.

Save 10% and get free shipping with a subscription!Fight viruses, remove heavy metals and microplastics, and restore your gut all at once with

Humic and Fulvic Acid from Ascent Nutrition.

MUST HAVE DETOX POWERHOUSE!

Stillness in the Storm Editor: Why did we post this?

The news is important to all people because it is where we come to know new things about the world, which leads to the development of more life goals that lead to life wisdom. The news also serves as a social connection tool, as we tend to relate to those who know about and believe the things we do. With the power of an open truth-seeking mind in hand, the individual can grow wise and the collective can prosper.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammatical mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

https://nworeport.me/2021/03/16/bidens-new-tax-hikes-may-effectively-wipe-out-1400-stimulus-checks/

Leave a Reply