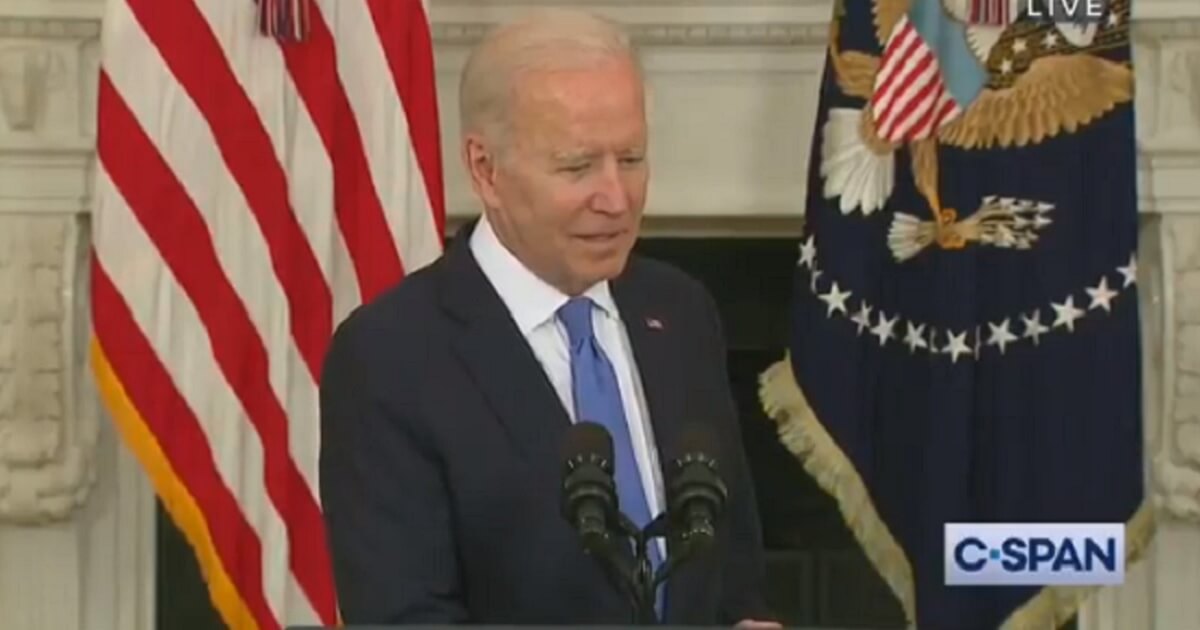

(C. Douglas Golden) President Joe Biden’s administration drew a line in the sand: If you made under $400,000, you wouldn’t see a single penny more in tax increases.

Related Trump’s Winter White House of Mar-a-Lago: Is He Secretly Still President?

Source – The Federalist Papers

by C. Douglas Golden, June 19th, 2021

And yet, the Biden administration was signing us up for trillions of new spending. How were they going to manage this neat trick? They couldn’t just deficit-spend their way out of this one. Instead, they were going to tax corporations and the ultra-wealthy.

In a March 31 speech in which he announced his infrastructure bill, according to a transcript from Rev.com. “I start with one rule: No one, let me say it again, no one making under $400,000 will see their federal taxes go up, period,” Biden said. “[H]ere’s the deal, right now a middle-class couple, a firefighter and a teacher with two kids making a combined salary of say 110, $120,000 a year pays 22 cents for each additional dollar they earn in federal income tax. But a multinational corporation that builds a factory abroad, brings it home to sell it, they pay nothing at all.”

And then Biden said again in his joint address to Congress on April 28, according to a USA Today transcript, “I will not impose any tax increases on people making less than $400,000 a year.

“It’s time for corporate America and the wealthiest 1 percent of Americans to pay their fair share. Just pay their fair share.”

You heard it over and over from the administration: Corporate tax. The one percent. Corporate tax. The one percent. Then, almost under their breath, spoken like the fine print in a radio ad: Oh yeah, and capital gains tax will go up, too.

That’s still generally a popular thing with voters, though. It conjures up images of consternated, well-coiffed men in front of a computer in a mahogany-soaked home office, sipping a single-malt scotch and grumbling about how they’d have to pick one of the less-desirable towns in the Hamptons to dock their yacht in next summer.

And that’s what the administration wants you to think — even though, to them, you or your children may very well be that man. You see, while the administration was speaking in the radio-ad voice, it was also saying the estate tax — the so-called “death tax” — would be subject to capital gains tax rules. For a lot of families making well under $400,000, their children are going to take one heck of a hit.

Currently, the estate tax only inheritances on property worth over $11.7 million for single taxpayers, $23.4 million for couples. Anything over that you pay taxes on. If you’re a single individual who inherits a $15.7 million estate, for instance, you’d pay taxes on $4 million.

The White House called this a “loophole that allows the wealthiest Americans to entirely escape tax on their wealth by passing it down to heirs.” In Biden’s American Families Plan — the last in his trilogy of trillion-dollar programs, the one designed to give Americans two years of government-paid college and 12 weeks of paid family and medical leave — he closes it. And how.

“The President’s plan will close this loophole, ending the practice of ‘stepping-up’ the basis for gains in excess of $1 million ($2.5 million per couple when combined with existing real estate exemptions) and making sure the gains are taxed if the property is not donated to charity,” the White House’s fact sheet on the American Families Plan read. “Without these changes, billions in capital income would continue to escape taxation entirely.”

Not only that, it would subject these estates to capital gains tax rates, which will be raised to 40.8 percent from 23.8 percent, according to The Wall Street Journal. This tax would be on unrealized gains, too — potential profits that exist on paper but haven’t been converted into actual wealth. This is the first time unrealized gains have been included in the estate tax.

In a Sunday article, The Journal’s Hank Adler and Madison Spach laid out just who this would hurt and how it would hurt them.

“To understand how uneven the burden of this tax is, consider a hypothetical taxpayer for whom it would be especially heavy: a woman who, as a young widow decades ago, bought a home in New York City for $250,000, reared her children there, and never remarried,” they wrote.

“The property is now worth $2.5 million and is her only asset. If she dies after the Biden plan becomes law, the estate itself wouldn’t be taxable, but it would be subject to the new death tax on $1 million of the unrealized gain from the home (the $2.25 million appreciation less the $1.25 million in exemptions). Her grown children would inherit $408,000 less than under current law. The Biden tax would be based on the value of the asset, not the equity, so the estate would be liable for the full amount regardless of any mortgage outstanding.”

Several families the U.K. Daily Mail talked to were quickly learning what the downsides of the new plan were, with one going so far as to call it “twisted.” While these families may be wealthier than average, they’re also not the Jeff Bezoses or Steve Jobses of the world. These are far from the “wealthiest Americans.”

Tom Hedger, 58, runs a family business that was started by his father. It was passed down to him in 2010, a year where the death tax was suspended. In 2019, they bought an $800,000 house in Maine — but, because the pandemic raised the value on real estate away from major cities, the value shot up. They also have Airbnb properties that will serve as their retirement business.

Now, they worry their children won’t be able to pay the bill when they die, either on the properties or the family business. Hedger said that if it hadn’t been suspended in the year the business was passed down, they “didn’t have the cash on hand to pay the estate tax. You basically would have been had to liquidate a huge amount of that.”

“It is insane — the concept that people are just sitting around with that amount of cash and the idea that somehow that money is more beneficial in the hands of the government,” Hedger said.

“My brothers are stressing our tremendously, they’d hoped to pass the business on too to the third generation. Now it’s like, what do you have to liquidate in order to be able to afford to pass it on to your family? It’s a question of can you afford your own family’s money?”

It’s worth noting the White House has said that the bill “will be designed with protections so that family-owned businesses and farms will not have to pay taxes when given to heirs who continue to run the business.” It remains to see how well those protections are designed if the bill is passed — or even if they were designed to protect those businesses in the first place.

“It is twisted to me that the government thinks they’re privy to this money and that somehow your success is a result of what they have done – it’s disgusting,” Hedger said. “The idea they’re going to take that cash and allocate it in a manner more effective that I could or that my children could.

“The threshold is so, so low. This is not just affecting the Bill Gates’ of the world. In fact, they’d barely be affected. It’s the small businesses. The families who have worked their whole lives.”

Vince and Patricia Sadd, both in their 60s, have three children, a grandchild and “a portfolio of property and business to leave to them when they die.” After Vince’s company was bought out, they moved from California to lower-tax states like North Carolina.

“We’ve worked hard and have been as savvy as we can be. This new law would be going too far,” 64-year-old Patricia said.

“You see the farmers, the average Joes, someone whose property really has appreciated, what do they do to be able to afford the taxes?” she added. “I just think they’re going to have to come up on with some remedy – you can’t lose a family asset because you can’t afford to pay the taxes… imagine not being able to afford your own inheritance?”

She also believes one thing will keep it from passing: Most members of Congress would be affected.

“This will affect way too many people, they’re going to have think of some kind of remedy for it,” she said.

As the Daily Mail pointed out, there are plenty of ways for the ultra-wealthy to get around this. They have estate planners working diligently plotting to keep their money out of the hands of the government.

They can figure out ways to transfer that wealth to their kids before they die without incurring penalties. The Sadds and the Hedgers? They’re the ones who’re going to take a hit, and they’re not anywhere near as rich as plutocrats the Biden administration says it’s targeting.

These are some of the more wealthy families that’ll be hit, too. People who make way less than $400,000 can accumulate an estate of over $1 million, particularly when real estate is factored in.

The one percent? Hardly. The Biden administration thinks that if you’re not paying it in income tax, you may think it’s not going to affect you. And you know what? They could be right. If this goes through, however, the Democratic Party’s millennial base will find out soon enough — when their parents’ property gets passed on to them — just how wrong this assumption was.

Save 10% and get free shipping with a subscription!Fight viruses, remove heavy metals and microplastics, and restore your gut all at once with

Humic and Fulvic Acid from Ascent Nutrition.

MUST HAVE DETOX POWERHOUSE!

Stillness in the Storm Editor: Why did we post this?

The news is important to all people because it is where we come to know new things about the world, which leads to the development of more life goals that lead to life wisdom. The news also serves as a social connection tool, as we tend to relate to those who know about and believe the things we do. With the power of an open truth-seeking mind in hand, the individual can grow wise and the collective can prosper.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammatical mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

https://thefederalistpapers.org/us/american-families-joe-biden-disgusted-twisted-death-tax

Support our work! (Avoid Big Tech PayPal and Patreon)DIRECT DONATION

Leave a Reply