(Tyler Durden) For the better part of the past decade, Wall Street traders would end their week with at least a casual glance at JPMorgan’s closely-followed cross-asset report written every week by the bank’s top x-asset strategist, John Normand. But not any more: as Normand wrote in his May 21 note published last Friday, “this is my last research note and video, as I am moving on after 24 years.” In his note, Normand discusses lessons “learned in over two decades with JPM Research, covering cross-asset strategy/asset allocation, Currencies, Commodities and Fixed Income” a period “which covers four business cycles, three US/global recessions and four financial crises (that didn’t cause US recessions), plus hundreds of weekly reports and client meetings.”

Related Dr. Ben Carson Warns That Biden’s Budget Will Turn America Into Venezuela

by Tyler Durden, May 30th, 2021

To be sure, the 13-page note is a useful reference for finance professionals, and covers various topics including:

- What makes cross-asset strategy most useful. (“Cross-asset strategy is an approach to alpha generation involving four elements: (1) a outlook and trade recommendations that span all asset classes and geographies, with an investment horizon of up to one year; (2) a mixture of high-conviction themes and recommendations from asset class specialists, combined with relative value judgments of a generalist; (3) a set of common macroeconomic and policy assumptions and standardized factor models that create internal consistency within a multi-asset model portfolio; and (4) opportunistic research around emerging macroeconomic, political or structural themes that could amplify the baseline view for multiple asset classes, or inform a downside risk scenario.”)

- How to time mostly efficient markets (“Tactical position-taking assumes one can time the market to outperform the benchmark, due to some combination of these factors: (1) markets are partially efficient; (2) some institutions have access to broader information sources than others; and (3) some analysts are better arrangers of a mosaic of even fully public information.”)

- Portfolio construction beginning with global themes rather than asset classes. (“Examples of core themes from which I choose in any given year include: (1) the macroeconomic regime defined by growth, corporate profits, inflation and monetary/fiscal policy, which has extensions to cross-asset factors such as Value, Momentum and Size; divergences in regime across regions matters too; (2) Commodities supply stress, as a price driver independent of the macro regime; (3) political/geopolitical opportunities and risks, because there is at least one material election somewhere annually; (4) China decoupling, because its credit, regulatory and investment cycles haven’t been fully synchronized with the DMs since the Global Financial Crisis”)

- The risk of overly-simplistic market narratives. (“This is a potential pitfall of narratives: they can be too simple for an environment that is much more complex, and where more analytic effort should be spent exploring the nuance and the aberrations than in reiterating the storyline in the face of changing facts.”)

- The balance between models and discretion. (“start with a theory based on Economics/Finance; test it against the data and over multiple business cycles, if possible; model asset prices on more stable fundamentals rather than on other volatile and sentiment-driven asset prices; and overlay judgment on statistics.”)

- The balance between traditional and alt-data. (“Altdata is useful in cross-asset investing only episodically than consistently. The conceptual issue is the representativeness of Big Data. The practical issue is the resource allocation to analyzing data sets which may only have a shelf life of a few months.”)

- The uses and abuses of the consensus. (“Focusing on non-consensus recommendations seems like a useful investment hook, because less crowded positions should move more when fundamentals change. This framing entails three shortcomings, however. One is that the consensus is actually correct directionally on some markets the majority of the time, as in Equities.Another is that consensus sell-side views are not always mirrored by investor positioning, which adjusts more slowly for large asset managers due to operational constraints. The third is that consensus itself drifts over time as the business cycle and policy evolve, in turn creating multi-quarter momentum in flows and prices.”)

- The limits of flow and positioning data. (“Flow and positioning data are useful in mapping market vulnerabilities, but these data can also mislead due to coverage gaps and reporting lags. Even where granular data are available by investor type and/or asset class, there is conceptual problem in assuming that any subset systematically leads or lags the broader market, given how the balance of participation shifts every cycle. In Bonds and Currencies, for example, non-US central banks led trends pre-GFC due to their reserve accumulation and diversification policies then, but are less influential now. In Equities, retail participation was influential in the late 1990s (dot-com era) and currently (meme stock trading), whereas quant funds and passive ETFs flows dominated in between.”)

- Valuing analysts for frameworks more than forecasts. (“All strategists have conscious or unconscious biases in how they formulate and express views, including: the factors they track; how they weight those factors mentally; what size market move they target over what horizon; and whether they attempt to manage drawdown around a baseline view. I still derive considerable value from engaging both perma-bulls and bears across various asset classes, because I am more interested in the factors they track and how they weigh them than in their point forecasts or specific recommendations. I can stress-test a factor or change mental weights to develop a risk scenario, whereas point forecasts are simply not malleable”)

While there is much more “big picture”, philosophical and even educational themes in his parting report, with Normand closing out with “thoughts for the younger generation”, which not surprisingly gravitate around bitcoin…

… the now former chief x-asset strategist couldn’t resist giving his perspective on a tactical topic, which in a few months will be long forgotten, namely “what phase best describes the market” – spawned by all the recent declarations that we are in a mid-cycle market, and linked to that what strategy should accompany it, and the risk of a market drawdown.

Here, Normand has some good and bad news:

- “The good news is that this cycle is barely a year old in terms of simple age (chart 18), except to those who consider it an extension of the 2009-2020 expansion. I consider this expansion to be a new one, because Fed policy is ultra-loose rather than tight; output gaps are generally negative rather than positive; and profit margins are above rather than below average (chart 19).”

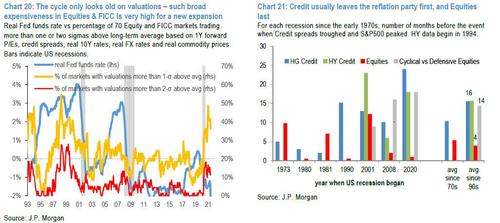

- “The bad news is that Equity and FICC markets have never been so broadly expensive this early in an expansion (chart 20), which thus leaves little risk premium to be earned as the cycle matures and provides little cushion for disappointment or random shocks. When real policy rates are positive and profit margins falling, we can properly use terms like late-cycle and implement the quite drastic portfolio rotations that are required to generate alpha”

The “bad news” is probably why Normand sees a “moderate” risk of a “meaningful” 10% drop in the MSCI’s all-world index which is “better preempted by holding a range of trades that benefit from a hawkish Fed (short DM duration, long USD, short Gold, long Value vs Growth, long MSCI EMU vs S&P) than by reducing Equity exposure overall.” So “If the catalyst will be a hawkish Fed due to rising inflation in the context of still-strong growth, the better risk-reward would be sell Fed-sensitive assets (bonds, gold, non-USD currencies, growth stocks) rather than to sell cyclically-sensitive ones (equities overall).”

Naturally, no JPMorganite could ever leave off on a bearish note which explains why even as Normand admits it will get ugly soon, he can’t bring himself to tell his clients to sell. One place where can do that, however, is in the asset class that has emerged as JPMorgan’s bogeyman in the past 5 years – cryptos, whose unprecedented eruption higher has made a joke out of Jamie Dimon’s infamous 2017 words when he said that bitcoin is a fraud and the CEO would “fire” any JPMorgan employee caught trading it.

Dumber words have never been spoken by a man as allegedly smart as Dimon, about an asset class that made millionaires and billionaires out of countless people (certainly not JPMorgan employees) who went against everything that Dimon had to say.

So yes, in keeping with JPMorgan’s party line – which is to publicly bash cryptos before the general public while privately accumulating them for its own prop desk – now that JPM traders no longer face termination for doing so especially in light of JPM’s recent expansion into cryptos as the bank launches its own actively managed bitcoin fund (what a change from Dimon’s idiotic 2017 words), Normand – who couldn’t bring himself to tell clients to sell stocks had no such qualms with bitcoin:

“… while I can believe that unrealistic expectations are often build (sic) into single securities, sectors and themes, I am less minded to believe that collective irrationality at the asset-class level is endemic. If I had to avoid any of the very expensive market now it would be Cryptocurrencies, because it entails two characteristics other rich markets lack: a penchant for high investor leverage, and a questionable investment these (sic) about the utility and efficiency of private money compared to legal tender.”

He concludes, “I am very comfortable investing in expensive equity markets. I am not comfortable investing in expensive crypto markets.”

And yet, toward the very end of the note, even the (former) high-priest of legacy asset picking at the largest US commercial bank could not stop himself from admitting what the real reason is to accumulate cryptos: simple, comprehensive insurance against a systemic collapse.

I see no value in hedging too little growth or too much inflation through Cryptocurrencies, due to issues with their intrinsic value. Unlike Bonds (or even Credit), they are not central bank policy targets in recessions. Unlike the dollar or the yen, Crypto is not a funding vehicle, so will not be bought back in times of market stress caused by either too little growth or too little inflation. If, however, one’s risk scenario is of the Thunderdome variant characterized by the simultaneous collapse of a currency and its payments system, then there is no better hedge than private, digital money.

Without going into too much detail how it is precisely the fact that central banks will not target crypto in a recession (can one imagine where the S&P would be if central banks had not injected $30 trillion in global markets to prop up stocks? And yes, central banks will never stabilize, bail-out or prop up crypto, and yet it is trading at levels that just a year ago would have seemed laughable to anyone but the most fervent bulls. In fact, as Normand admits bitcoin has now emerged as the most manipulation and intervention-free market in the world and yet in our centrally-planned society that is somehow a bad thing) that is what makes this fiat-alternative so attractive, we completely agree with Normand: there is no better hedge to the “simultaneous collapse of a currency and its payment system“… and the reason why we are confident we are just years away from this “Thunderdome” scenario is because the central banks themselves are now in a full-blown rush to come up with their own digital currencies as they all prepare to leave fiat behind after the next systemic crash, which not even the Fed’s open-market purchases of stocks will reverse.

It is this “scenario”, which even the high-priests of conventional economics and monetary finance, tacitly admit is coming, that is the reason why anyone selling cryptos just to convert them back into a fiat currency (albeit at a much higher price) that won’t exist in a few years, is as delusional as those who read Normand’s final note and concluded that he said “sell it.”

Save 10% and get free shipping with a subscription!Fight viruses, remove heavy metals and microplastics, and restore your gut all at once with

Humic and Fulvic Acid from Ascent Nutrition.

MUST HAVE DETOX POWERHOUSE!

Stillness in the Storm Editor: Why did we post this?

The news is important to all people because it is where we come to know new things about the world, which leads to the development of more life goals that lead to life wisdom. The news also serves as a social connection tool, as we tend to relate to those who know about and believe the things we do. With the power of an open truth-seeking mind in hand, the individual can grow wise and the collective can prosper.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammatical mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

Support our work! (Avoid Big Tech PayPal and Patreon)DIRECT DONATION

Leave a Reply