2 articles in this post.

Banks are stockpiling cash ahead of anticipated financial panic

Source

(NaturalNews) As the government shutdown grinds on with no end in sight, as President Obama continues to vow not to negotiate with House Republicans over raising the debt ceiling limit and funding Obamacare, many of the nation’s biggest banks are stockpiling cash for ATM machines in case the public becomes panicked over a potential U.S. default.

Per London’s Telegraph newspaper:

Major banks have increased the amount of funds by around a third, and are holding daily meetings in sealed rooms to map out their contingency plans, according to well-placed sources.

In some cases, they are discussing the possibility of extending free credit to customers who do not receive the Social Security payments they would normally rely on, because of the ongoing services blackout.

Would a shutdown cause a run on cash at the banks

The U.S. government shut down, partially, Oct. 1, after Obama and House Republicans failed to come to an agreement over a budget and continuing resolution that would have kept some services running and many government workers at their jobs. As it stands, the shutdown is only affecting about 17 percent of the federal government’s traditional functions.

It’s the first federal government shutdown in 17 years; the last one occurred during Bill Clinton’s first term.

At issue is the funding of Obamacare, which Republicans in the House are seeking to block, as well as whether or not to raise the nation’s borrowing limit – the so-called debt ceiling – which currently stands at $16.7 trillion (or about 100 percent of total U.S. annual gross domestic product).

Congress has until Oct. 17 to reach an agreement to raise the limit or offer some kind of short-term budget compromise that the Democrat-controlled Senate and White House would accept, which appears unlikely at the time.

Backers of a raise in the ceiling, which includes Obama, say it is needed to avoid a U.S. default on sovereign debt. Opponents say the ceiling increase should not happen, because the country is already too deeply in debt; besides, they note that the U.S. government brings in plenty of tax and other revenues monthly to handle its interest and debt payments.

Nevertheless, primarily because of the way the issue is being portrayed by the press, there is concern among some of the large banks that a run of cash could be in the offing.

Americans are already hoarding cash as well

More from the Telegraph:

Banking sources told the Daily Telegraph that they had learned many lessons from a similar game of political brinkmanship in August 2011, when budget negotiations and concerns over the eurozone crisis triggered a sharp drop in stock prices around the world. The market turmoil induced panic among customers, who made a run on banks to withdraw their cash.

“That was the fire drill, but that’s also what happens around ‘disasters’ such as hurricanes or earthquakes,” one source told the paper. “We all have that disaster playbook on the shelf.”

Indeed, banks have been hoarding cash for years, including cash they have been pressured to loan . Whether or not there will be panic if Washington doesn’t come to a budget deal remains to be seen, but it never hurts to have some assets on hand at all times in any event.

Source:

http://www.naturalnews.com/042424_banks_stockpiling_cash_financial_panic.html

________________________________________________________

|

| A view of a the new 2009 series $100 bill on Oct. 4 in Washington. Photograph by Brendan Smialowski/AFP via Getty Images |

D. asked me to post this as she is busy right now. -Bill

D’s comments below in blue:

[10/9/13 12:12:38 PM] D: yep- lower right hand side- it says “Series 2009” thank you bloomberg and main stream media for showing us the transparency!

[10/9/13 12:14:38 PM] D: history: in Oct 2011 I saw the first copy of a photo of the “new” $100 bill. I didnt’ think anything of it at the time. then in 2012 other “leaked” photos of the “New” $100. I blew up the photo and noticed that right there on the bill it says : “series 2009”

[10/9/13 12:14:51 PM] D: it also says it’s a Federal Reserve Note.

[10/9/13 12:15:37 PM] D: the Fed hasn’t had any printing presses or printed a single bill of any denomination since 2009- which makes this photo really hysterical.

[10/9/13 12:17:11 PM] D: So they printed them all in 2009 and held onto them. They were suppose to be released in 2011, then in 2012, then 3 different times in 2013….. and yet, they haven’t been released.

[10/9/13 12:17:43 PM] D: Now why would that be? Oh we all know the official excuses (apparently, they just keep printing them wrong (facepalm))

[10/9/13 12:18:04 PM] D: or…. is it that they have nothing to back the new $100 bills with :D

http://www.businessweek.com/articles/2013-10-08/these-new-100-bills-are-going-to-be-huge-overseas

These New $100 Bills Are Going to Be Huge Overseas

By Mark Glassman October 08, 2013

In the midst of a government shutdown over federal spending, a new $100 bill began circulating Tuesday. At least we assume it did: The U.S. Treasury, like much of the government, couldn’t be reached for comment, and no one is making change with a crisp, new hundred this morning. (Update: The Fed confirmed late Tuesday night that the new $100s went into circulation without a hitch.)

The Series 2009 $100 note is more expensive to print than the last version—12.7¢ per bill vs. 7.8¢ for the older style—but it’s designed to be harder to counterfeit and easier to authenticate. The hundred note still features Ben Franklin on the front and Independence Hall on the back, along with more colorful illustrations and hidden text and pictographs that reveal themselves only under certain conditions.

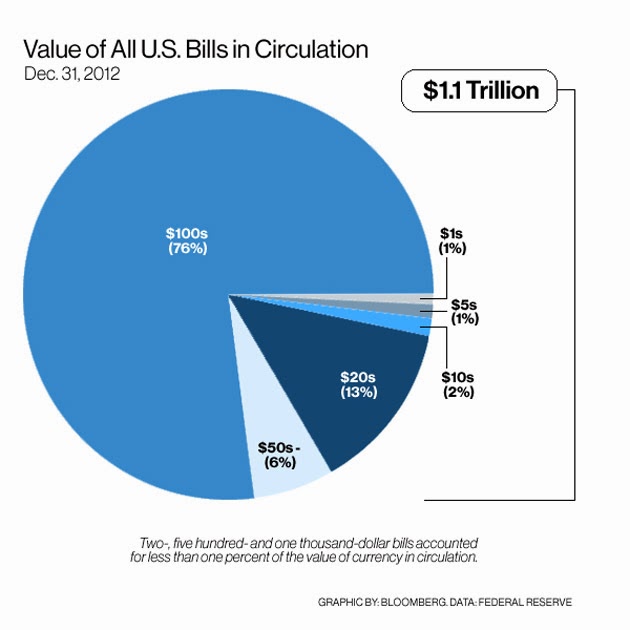

If now feels like a bizarre time to begin printing new, more expensive money, rest assured that the $100 bill plays an essential role in the U.S. economy. Although most Americans are unlikely to use the new note regularly, if at all, the hundred is by far the largest store of value for all circulating U.S. currency.

GRAPHIC: Ben Franklin’s Face-Lift: The New $100 Bill

At the end of 2012, there were about $10 billion in singles in circulation, according to the Federal Reserve. There were $863 billion in hundreds making the rounds—more than three-quarters of the value of all U.S. notes. Although hundreds are the most commonly counterfeited bill, they have grown significantly more important to the economy over the last 20 years.

Bill Adams, senior economist at PNC Financial (PNC), estimates that from 1992 to 2012, the share of the U.S. gross domestic product accounted for by hundred-dollar bills doubled. Today, he says, hundreds represent close to 6 percent of gross domestic product.

Most of that currency is probably not in the United States. In 2010, Fed Chairman Ben Bernanke noted that up to two-thirds of all hundred notes are circulating abroad.

VIDEO: El-Erian Gets His Hands on the New $100 Bill

The hundred typically has a longer lifespan than other bills because it is used less frequently. The average hundred circulatesfor about 15 years, according to the Fed.

The new bill is also arriving a little late. It was supposed to go into circulation in February 2011, but a production problem caused delays. Its predecessor arrived on March 25, 1996—80 days after the last government shutdown.

STORY: Three Subtle Changes to the Flashy New $100 Bill

Source:

http://americankabuki.blogspot.com/2013/10/these-new-100-bills-are-going-to-be.html

Leave a Reply