(Zero Hedge) For those hoping that the dollar shortage and overnight funding crunch would ease on the third day after the G/C repo rate exploded as high as 10%, we have bad news: it has not.

by Staff Writer, September 19th, 2019

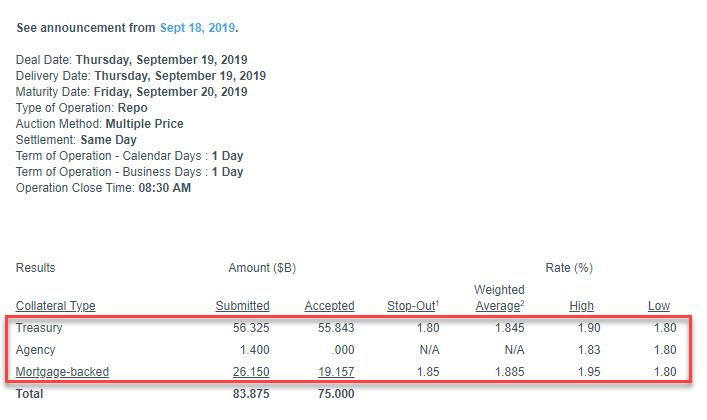

As we warned earlier today, when we previewed the result of today’s repo outcome, the only question would be whether the amount of bids submitted into today’s operation would be higher or lower than yesterday’s $80.05BN to get a sense of whether the funding pressure is easing. The answer: with $83.875BN in total bids submitted, not only was the $75BN operation oversubscribed again, but the total liquidity shortfall rose by almost $4 billion compared to Wednesday morning.

Furthermore, the fact that the operation was again oversubscribed means that once again there was one or more participants who did not get up to €9 billion in the critical liquidity they needed, and that the Fed will see a chorus of demands by everyone (because just like with the discount window “stigma”, nobody will dare to be singled out as the party seeking repo funds) to either expand the size of its operations, implement a fixed operation and/or transition to permanent open market operations, i.e. QE, as Powell hinted he may do yesterday.

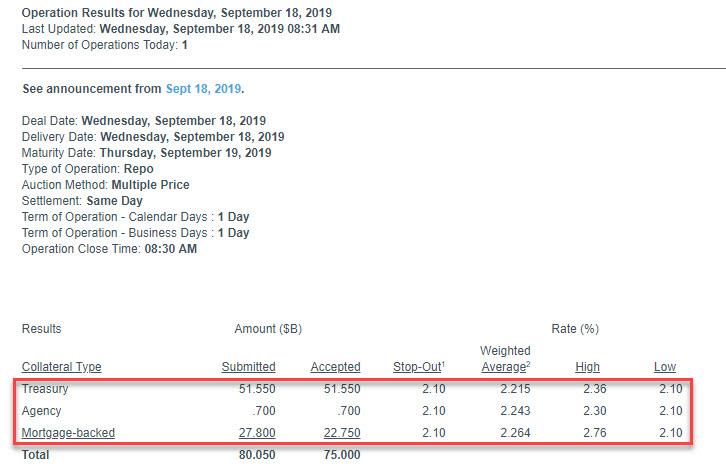

By comparison this is what yesterday’s repo operation looked like:

Both of these are over 50% greater than the $53.15BN repo operation conducted on Tuesday.

What is immediately notable is that except for agency paper, there was a greater use of Treasury ($51.6N to $56.3BN) collateral, while Mortgage-backed dipped slightly ($27.8BN to $26.15BN). Additionally no agency paper was used as collateral in today’s repo, down from Wednesday’s $0.7BN.

We now await today’s effective fed funds print to see if it will again print above the top of the new fed funds range (2.00%), and whether the overnight repo rate will reverse its earlier drop as it is becomes clear that the funding crisis is nowhere near over.

Buy Book Make Money Cryptocurrency Trading: The Basics

* * *

Earlier:

As the Fed pre-announced late on Wednesday, moments ago the New York Fed open markets desk started its daily overnight repo operation to provide liquidity to the financial system. It comes as funding markets appear to have settled down overnight, with the overnight general collateral repo rate opening at 2.25% before dropping as low as 1.95%-2.00% according to ICAP, while the SOFT rate dropping sharply from the mid-5% to 2.55%, which however remains quite elevated relative to the new Fed Funds range of 1.75%-2.00%

The market will be looking at the amount of repos tendered to the Fed and whether the operation will again be oversubscribed; as a reminder, on Tuesday the repo received $53BN in bids, which jumped 50% on Wednesday to just over $80BN, while the operation remains capped at $75BN. Should the total notional remain in this ballpark it will suggest that funding stress remains.

Stillness in the Storm Editor: Why did we post this?

The preceding information is a news update. In general, staying informed as to events taking place is essential as an individual because it helps you navigate the world, and socially because you can gain and maintain rapport with your fellows. This rapport can be used to share information that can help others and improve the conditions of humanity in general. However, one must learn how to exercise discernment and proper critical thinking so they can make effective use of information gained.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammar mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

https://www.zerohedge.com/markets/fed-begins-repo-operation-funding-rates-ease

Leave a Reply