(Zero Hedge) It’s a relatively quiet week event-wise, where outside of the VP debate on Wednesday we get the latest minutes from recent Fed (Weds) and ECB (Thurs) meetings, and also hear from both Fed Chair Powell (tomorrow) and ECB President Lagarde (tomorrow and Weds).

by Staff Writer, October, 5th, 2020

As DB’s Jim Reid notes, it’s also quiet for central banks, with the only G20 decision coming from the Reserve Bank of Australia tomorrow: economists expects no change in policy, but we will be watching for clues about whether a rate cut might yet be delivered by the end of the year.

The main data highlight will likely be the release of the services and composite PMIs from around the world. Most are today but the U.K. comes tomorrow and China’s on Thursday after holidays. The flash readings showed clear signs of the services sector in Europe being affected by the second wave of Covid-19, with the flash Euro Area services PMI falling to 47.6, which is below the 50-mark that separates expansion from contraction, with both Germany (49.1) and France (48.5) also in contractionary territory. We will see if this trend is confirmed and whether there was any late month deterioration from the initial flash reading.

Some more observations courtesy of Anthony Cheung and Amplify Trading:

ASIA

Reminder, China on holiday until Friday.

TRUMP

Conflicting reports over the weekend on Trump’s health. Chief of staff, Mark Meadows after he said the president’s vital signs looked troubling which is contradictory to chief physician Sean Conley who said Trump had made “substantial progress” and “spent most of the afternoon conducting business.” He is now on dose two of five of the experimental antiviral drug Remdesivir and is not experiencing any side effects. If things continue to go well, he may be allowed to continue his treatment back at the White House on Monday, his team said.

Net net: Common belief is giving timing, the next few days are key as to whether the virus symptoms become more aggressive or not.

US CALENDAR

The US data focus will be the ISM services survey (Mon) and weekly jobless claims (Thu). Not expecting a great deal from FOMC mins where the Fed updated forward guidance with intro of AIT. Fed Chairman Powell (Tue) is among lots of Fed officials scheduled to give a keynote speech on the economic outlook this week (Weds), expect more calls for fiscal stimulus.

Last weeks markets were ultra sensitive to stimulus talk developments so the same level of vigilance is warranted this week. Pelosi on Sunday said progress was being made on coronavirus relief legislation. Following a contentious first presidential debate, focus will now shift to Wednesday’s VP debate between Mike Pence and Senator Kamala Harris (Wednesday).

ECB

Recent “sources” reported that splits among the Governing Council were already apparent at the last ECB meeting, so we may see more divergent opinions in the accounts from the Sept meeting. Apparently the hawks wanted to quietly slow the pace of PEPP buying and thought the macro forecasts were too pessimistic, while the doves wanted a stronger warning against EUR strength (TD). There will also be a whole host of ECB speakers running from Tuesday through Thursday. Lagarde speaks twice on Tuesday.

RBA

Speculation about a possible rate cut from the Reserve Bank of Australia has risen in the past few weeks, and next week’s RBA meeting will therefore be an important one. We do not expect a rate cut, although a shift to a more dovish rhetoric may be on the cards. The futures market seems to be pricing in around a 68% chance of a cut at this meeting, so we think the balance of risks for AUD is slightly tilted to the upside next week.

OIL

Libya’s oil output has risen to 295,000 barrels (eastern ports of Hariga, Brega and Zueitina) following a truce in the OPEC nation’s civil war and the lifting of a blockade on energy facilities. Saudi Arabia’s Finance Ministry sees oil prices at around $50 a barrel for the next three years, according to Goldman Sachs Group Inc.’s analysis of the kingdom’s pre-budget statement.

* * *

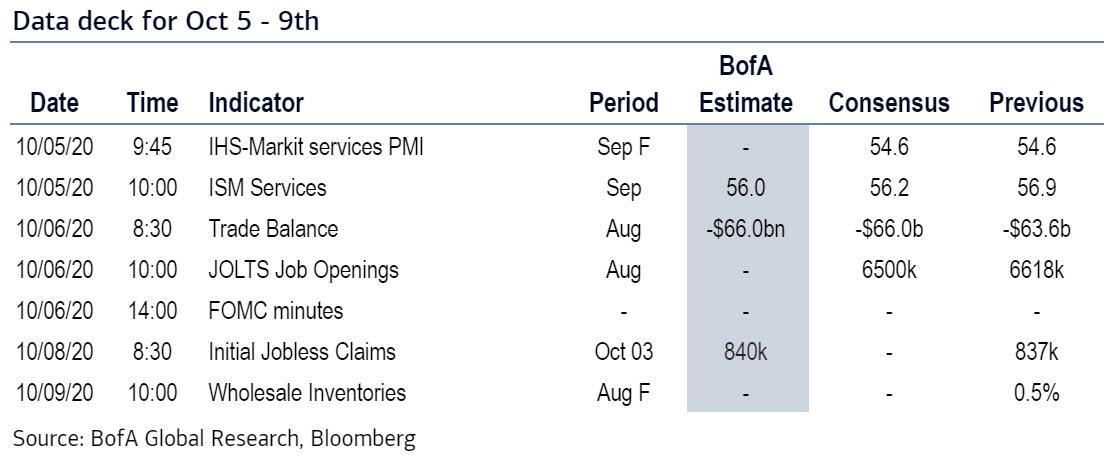

A day-by-day calendar of key events is below, courtesy of Deutsche Bank:

Monday October 5

- Data: September services and composite PMIs from Japan, Russia, Italy, France, Germany, Euro Area UK, Brazil and US, Euro Area August retail sales, US September ISM services index

- Central Banks: Fed’s Evans, Bostic speak

Tuesday October 6

- Data: Germany August factory orders, September construction PMI, UK September construction PMI, Canada August international merchandise trade, US August trade balance, JOLTS job openings

- Central Banks: Reserve Bank of Australia monetary policy decision, ECB President Lagarde, Chief Economist Lane, Fed Chair Powell, and Fed’s Harker, Bostic and Kaplan speak

Wednesday October 7

- Data: Japan preliminary August leading index, Germany August industrial production, Italy August retail sales, US weekly MBA mortgage applications, August consumer credit

- Central Banks: FOMC release meeting minutes, ECB President Lagarde, ECB’s Villeroy, Fed’s Rosengren, Bostic, Kashkari, Williams, Evans speak

- Politics: US Vice Presidential Debate

Thursday October 8

- Data: Japan August current account balance, China September services and composite PMI, Bank of France September industry sentiment indicator, Germany August trade balance, Canada September housing starts, US weekly initial jobless claims

- Central Banks: ECB release monetary policy account, Bank of England Governor Bailey, Bank of Canada Governor Macklem, ECB’s Schnabel and Hernandez de Cos speak

Friday October 9

- Data: UK August GDP, France August industrial production, Italy August industrial production, Canada September net change in employment, unemployment rate, US final August wholesale inventories

* * *

Looking at just the US, the key economic data releases this week are the ISM non-manufacturing index on Monday and initial jobless claims on Thursday. In addition, minutes from the September FOMC meeting will be released on Wednesday. There are numerous scheduled speaking engagements by Fed officials this week, including Fed Chair Powell on Tuesday and New York Fed President Williams on Wednesday.

Monday, October 5

- 09:45 AM Markit US services PMI, September final (consensus 54.6, last 54.6)

- 10:00 AM ISM non-manufacturing index, September (GS 55.9, consensus 56.1, last 56.9); While our non-manufacturing survey tracker increased (+1.3pt to 54.7), its level remains somewhat below the ISM non-manufacturing index. We also note scope for the ISM supplier deliveries component to retrench after its sharp rebound in last month’s report (+5.3pt to 60.5). Taken together, we estimate the ISM non-manufacturing index declined by 1.0pt to 55.9 in September.

- 10:45 AM Chicago Fed President Evans (FOMC non-voter) speaks; Chicago Fed President Charles Evans will give a luncheon address to the annual meeting of the National Association for Business Economics in Chicago. Prepared text is expected.

- 03:15 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on regulating fintech at a Fintech South event. Audience Q&A is expected.

- Tuesday, October 6

- 08:30 AM Trade balance, August (GS -$66.4bn, consensus -$66.4bn, last -$63.6bn): We estimate the trade deficit increased by $2.8bn further in August, reflecting an increase in the goods trade deficit.

- 10:00 AM JOLTS job openings, August (consensus 6,500k, last 6,618k)

- 10:40 AM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell is the keynote speaker at the annual meeting of the National Association for Business Economics in Chicago. Powell will speak on the U.S. economic outlook and take questions from a moderator. Prepared text is expected.

- 11:45 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will discuss machine learning in a webinar hosted by the Global Interdependence Center. Prepared text and audience Q&A are expected.

- 02:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak to Leadership Florida about “An Inclusive Recovery.” Audience Q&A is expected.

- 04:00 PM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will discuss the U.S. and global economy with Bank of Mexico Governor Alejandro Díaz de Leónin in a webcast.

Wednesday, October 7

- 01:00 PM Boston Fed President Rosengren (FOMC non-voter), Atlanta Fed President Raphael Bostic (FOMC non-voter), and Minnesota Fed President Neel Kashkari (FOMC voter) speak; Boston Fed President Eric Rosengren, Atlanta Fed President Raphael Bostic, and Minnesota Fed President Neel Kashkari will host a virtual series titled “Racism and the Economy.”

- 02:00 PM Minutes from the September 15-16 FOMC meeting; At its September meeting, the FOMC left the target range for the policy rate unchanged at 0-0.25%, as widely expected. The FOMC also introduced new forward guidance which delays liftoff until the economy has reached maximum employment and inflation has risen to 2% and “is on track to moderately exceed 2 percent for some time.” The FOMC chose not to provide a timeline for asset purchases and did not change the composition of its Treasury purchases. In the minutes, we will look for further discussion on the forward guidance and asset purchase policies.

- 02:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will moderate a discussion with Henry Kissinger in an event hosted by the Economic Club of New York.

- 03:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will discuss flexible average inflation targeting with John Taylor at an event hosted by the Hoover Economic Policy Working Group.

- 04:30 PM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will discuss the U.S. economic outlook in a virtual event hosted by the Metals Service Center Institute. Prepared text is expected.

Thursday, October 8

- 08:30 AM Initial jobless claims, week ended October 3 (GS 810k, consensus 820k, last 837k); Continuing jobless claims, week ended September 26 (consensus 11,400k, last 11,767k): We estimate initial jobless claim decreased to 810k in the week ended October 3.

Friday, October 9

- 10:00 AM Wholesale inventories, August final (consensus +0.5%, last +0.5%)

- 12:10 PM Boston Fed President Rosengren (FOMC non-voter); Boston Fed President Eric Rosengren will speak on “Economic Fragility: Implications for Recovery from the Pandemic” at the virtual Marburg Memorial Lecture hosted by Marquette University. Prepared text and audience Q&A are expected.

- 02:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks; Atlanta Fed President Raphael Bostic will speak in a panel discussion to the Rework America Alliance group.

Stillness in the Storm Editor: Why did we post this?

The news is important to all people because it is where we come to know new things about the world, which leads to the development of more life goals that lead to life wisdom. The news also serves as a social connection tool, as we tend to relate to those who know about and believe the things we do. With the power of an open truth-seeking mind in hand, the individual can grow wise and the collective can prosper.

– Justin

Not sure how to make sense of this? Want to learn how to discern like a pro? Read this essential guide to discernment, analysis of claims, and understanding the truth in a world of deception: 4 Key Steps of Discernment – Advanced Truth-Seeking Tools.

Stillness in the Storm Editor’s note: Did you find a spelling error or grammatical mistake? Send an email to [email protected], with the error and suggested correction, along with the headline and url. Do you think this article needs an update? Or do you just have some feedback? Send us an email at [email protected]. Thank you for reading.

Source:

https://www.zerohedge.com/economics/key-events-week-powell-vp-debate-ism-and-fed-speakers-galore

Leave a Reply